Hosting Expense Procedures – February 13, 2012

Page 1 of 7

HOSTING EXPENSE PROCEDURES

Procedure

Type:

Management

Initially

Approved:

January 1, 2011

Procedure

Sponsor:

VP, Finance &

Administration

Last

Revised:

February 13,

2012

Administrative

Responsibility:

AVP, Finance and

Commercial

Operations

Review

Scheduled:

May 2025

Approver:

Executive Leadership Team

A.

PURPOSE

Based on the principles stated in the Hosting Expense Policy, the purpose of this document is to

guide the hosting activities initiated on behalf of the University and address the payment or

reimbursement of related expenditures. The provisions contained in this document are mandatory

to ensure employees are appropriately reimbursed; and, direct the appropriate considerations and

authority for hosting events, taking into consideration the expectations of a publicly funded

institution.

B.

PROCEDURES

1.

ADMINISTRATION

1.1

Authorization

a.

The Expense Approver of the Employer have the responsibility to

authorize and initiate hosting and to ensure that all related arrangements

are consistent with the principles of the Hosting Policy and as spelled out

in this document.

b.

The review and approval of expense claims is to be carried out by Vice-

Presidents, Associate Vice-Presidents, Deans, Directors, Department

Heads, or designated Managers/Chairs for each respective area. These

individuals have the authority and are responsible/accountable for

determining the overall reasonableness of the claims and for making

exceptions to the normal guidelines when circumstances warrant such

action. All exceptions are to be in keeping with the guiding principles of

this Policy. In all circumstances, reimbursement claims must be approved

by one administrative level higher than the claimant (one-over approval).

c.

Reports and reimbursement claims for expenses incurred by the President

require both the review and approval of the Vice-President, Finance &

Administration as well as the approval of the Chair of the Board of

Governors.

Hosting Expense Procedures – February 13, 2012

Page 2 of 7

1.2

Level of Expenditure

a.

The Hosting Expense Policy requires that all claims be reasonable, reflect

prudence, good judgment, due diligence and be defensible to an impartial

observer.

b.

The impartial observer to whom we, as a public institution, can anticipate

having to defend the reasonableness of our claims may include: auditors,

internal or external, representing any of the funding organizations that

support activities at the University and Provincial level; and, members of

the public and any form of media who wish to scrutinize specific activities

by query or through the means offered in the Government of Alberta's

Freedom of Information and Protection of Privacy Act.

1.3

Receipts

a.

A detailed receipt is that provided by the vendor or supplier which

demonstrates the individual items or services purchased. A slip

demonstrating the total paid and the tender type (cash, debit card, credit

card, etc.) is not considered a detailed receipt.

b.

Reimbursement for all Hosting activities shall be made only upon the

presentation of complete documentation of the expenses including:

i.

Detailed receipt including: itemized expenses incurred,

date, and name of supplier (i.e., restaurant, caterer, venue).

ii.

Purpose of the event.

iii.

List of attendees:

•

For events where meals and/or beverages are ordered and

provided individually; where individuals are specifically invited

to participate; or for gatherings which do not meet the

following description of large social events, a specific list of

individual attendees including name, department or external

organization represented, is required.

•

For large social events where meals are not ordered or

provided individually and involving large groups of people

where capturing individuals in impractical (i.e., involving

several departments, entire Divisions, or the University as a

whole and/or large external delegations), a list of the groups

invited along with an estimate of the number of persons that

actually attended is sufficient.

1.4

Use of University Purchasing Cards (P-cards) for Hosting Activities

a.

Where available, employees may use University P-cards for hosting of

meals and related costs. All such expenditures incurred must adhere to

the University policies.

b.

Where the Hosting activities include the provision of alcohol, those

charges must be clearly distinguishable from or within the balance of the

bill being charged.

1.5

Loyalty Programs

a.

Individuals may join loyalty programs and retain benefits offered for

business or personal use provided that there are no additional costs to the

Hosting Expense Procedures – February 13, 2012

Page 3 of 7

University. If an Employee is using any form of affinity card (i.e., AirMiles,

Aeroplan, etc.) for University expenditures, it is the Employee's

responsibility to declare a taxable benefit upon redemption of their affinity

points earned from Employer paid expense per tax legislation as dictated

by the Canada Revenue Agency (CRA) under Income Tax Bulletin --

IT470R -- Employee Fringe Benefits.

2.

HOSTING AND BUSINESS EXPENSES (EXTERNAL AND INTERNAL)

Hosting activities of the University are carried out to facilitate business operations and

celebrate institutional milestones. At all times, Hosting activities should be planned and

carried out with due consideration of the principles of this Policy.

2.1

External Hosting

a.

The cost of hosting individuals external to the University and related to the

conduct of University business may be reimbursed. The Hosting

expenses may include food, beverages, social or recreational activities

and tokens of appreciation in the form of gifts of modest value. Expenses

should be kept to a reasonable costs, exercising professional discretion,

and involve only those expenses appropriate to the objectives and/or

significance of the event and respectful hosting of the external party.

b.

Alcohol provided will be limited to prior to or during a luncheon, dinner, or

reception, where food and refreshments are provided and only where 50%

or more of the hosted gathering are external to the University. All such

gatherings must be directly related to the promotion and advancement of

the University. Where alcohol is made available it shall be carried out in

adherence with the law and any licensing requirements.

c.

In keeping with the principle of one-over approval of Hosting expenditures,

the most senior person in attendance from the Hosting unit is to pay and

expense the related costs. It is important to distinguish between the most

senior attending member of the University and that of the Hosting unit.

This is to say that if the President of the University attends a function as

an invited guest of the Hosting unit, it is appropriate that the most senior

attendee from the Hosting unit cover and expense the Hosting costs, not

the President. However, if the Office of the President is the Host and the

President is in attendance, the President should pay and expense the cost.

d.

As required by law due to the University's status as a registered charity,

no reimbursement may be made to any University employee or member

of the Board of Governors for the attendance or expenditure at University

or Foundation fund-raising events.

University officials or representatives are free to attend political fundraising

dinners or events as a guest. All university employees are free to attend

such events at their own expense. In the event a university official or

representative finds it necessary to purchase a ticket for business

conducted on behalf of the University, the expense will be reimbursed in

accordance with the limits stipulated in the Alberta Election Finances and

Contributions Disclosure Act:

Hosting Expense Procedures – February 13, 2012

Page 4 of 7

Fund-raising Functions

23(1)

In this section, "fund-raising function" includes any social function

held for the purpose of raising funds for the registered party, registered

constituency association or registered candidate by whom or on whose

behalf the function is held.

(2) The gross income from any fund-raising function must be recorded by

the chief financial officer of the registered party, registered constituency

association or registered candidate that held the function or on whose

behalf the function was held.

(3) If an individual charge by the sale of tickets or otherwise is made for a

fund-raising function held by or on behalf of a registered party, registered

constituency association or registered candidate, then for the purposes of

this Act,

(a) if the individual charge is $50 or less, it shall not be considered

as a contribution unless the person who pays the charge

specifically requests that it be so considered, in which case 1/2

shall be allowed for expenses and 1/2 shall be considered as a

contribution to the registered party, registered constituency

association or registered candidate, as the case may be, and

(b) if the individual charge is more than $50, $25 shall be allowed

for expenses and the balance shall be considered as a

contribution to the registered party, registered constituency

association or registered candidate, as the case may be.

(4) The price paid by a person at a fund-raising function in excess of the

market value at that time for goods or services received is considered to

be a contribution to the registered party, registered constituency

association or registered candidate, as the case may be.

e.

In planning Hosting activities, if there is any doubt on the appropriate level

of expenditure or the provision of alcohol at the University's expense, the

organizer should obtain prior approval from their respective Vice-

President.

2.2

Internal Hosting – Small Group

(i.e., Department or Individual Recognition and Working Sessions)

a

.

From time to time, Division Heads, Associate Vice-Presidents, Deans,

Directors, Managers and Chairs may incur meal expenses for the

purposes of individual or small group recognition and/or working sessions.

b.

The Hosting costs associated with such activity are to be paid and the

expense claimed, by the most senior person of the operating group hosting

the gathering.

c.

University reimbursement or expenditure for alcohol is not permitted for

internal hosting of small groups for department, group or individual

recognition or for working committees such as retreats and hiring

committees. In rare or exceptional circumstances, the President may

waive this restriction through approval prior to the function. Where alcohol

is made available via cash bar on site for internally hosted functions, such

Hosting Expense Procedures – February 13, 2012

Page 5 of 7

provision shall be carried out in adherence with the law and any licensing

requirements. The service fee charged by the food services provider for

the provision of a cash par is an acceptable University expense.

d.

Members of the Board of Governors or a Program Advisory Committee

who are not current employees of the University are deemed external to

the University.

2.3

Internal Hosting – Large Social Functions

(i.e., University-wide or Division-wide, Christmas reception)

a.

By the authority of each Division Head, Associate Vice-President, Dean or

Director, and where budgets allow, expenditures for employee social

events may be reimbursed. In planning the frequency and cumulative cost

of internally hosted social events, the Expense Approver is reminded of

their responsibilities to act in a prudent manner in keeping with the nature

of the University as a publicly funded institution as well as the potential for

such cumulative costs for individual recipients to reach the level of taxable

benefits as defined by current Federal and Provincial tax legislation. For

current information on such tax limits, please contact Employee Services

or Finance Services.

b.

University expense or reimbursements for alcohol at large internally

hosted social functions is not permitted. In rare or exceptional

circumstances, the President may waive this restriction through approval

prior to the function. Where alcohol is made available via cash bar on site,

such provision shall be carried out in adherence with the law and any

licensing requirements. The service fee charged by the food services

provider for the provision of a cash bar is an acceptable University

expense.

C.

DEFINITIONS

(1)

Alcohol:

Alcoholic beverages. All provision and consumption of

alcohol on the Mount Royal University premises must be in

adherence to the law.

(2)

Employee:

means individuals who are engaged to work for the

University under an employment contract, including but not

limited to faculty, staff, exempt, casual and management

employees

(3)

Employer:

Mount Royal University, the Mount Royal University

Foundation or the Mount Royal University Child Care

Centre

(4)

Expense Approver:

Means the individuals holding specified positions with the

responsibility and authority to authorize expenditures. The

authority to approve Hosting activity reimbursement claims

may not be delegated below the level of Manager or Chair.

(5)

External Hosting:

Hosting activities carried out to promote University

business and advancement, where 50% or more of the

group being hosted are external to the University; i.e.,

private sector representatives, government officials,

industry officials and/or international dignitaries, etc.

Hosting Expense Procedures – February 13, 2012

Page 6 of 7

(6)

Internal Hosting:

Hosting activities carried out to promote University

business and advancement, where 50% or more of the

group being hosted are University employees and/or

students.

(7)

Policy:

means the Hosting Expense Policy

(8)

Prior Approval:

Written approval for hosting activities obtained prior to

making related commitments or expenditures and prior to

the start of the activity.

(9)

Purchasing Card

(P-Card):

a credit card supplied by a financial institution and used by

Mount Royal to enable cardholders to make purchases and

payment of low dollar value purchases, travel and hosting

expenses

(10)

Reasonable

Expense:

An expenditure that is considered to reflect prudence, good

judgment, due diligence and is defensible as a business

activity to an impartial observer.

(11)

Receipt

An original detailed document, provided by the merchant

showing the name and address of the merchant, the CRA

issued business number (if Canadian and applicable), the

date of the purchase, an invoice/receipt number, an

itemized description of the goods or services purchased,

the total amount of tax charged, any shipping charges (if

applicable), and the total amount of the invoice including

taxes and delivery and/or service charges. The submission

of a credit card or debit card receipt indicating payment is

not sufficient on its own.

(12)

Student:

A student of the University currently enrolled in the program

offered at the University. Students are considered internal

to the University community where hosting activities are

concerned.

(13)

University:

means Mount Royal University

D.

RELATED POLICIES

•

Hosting Expense Policy

•

Public Disclosure of Expenses Policy

•

Contractual Signing Authority Policy

•

Travel and Expense Policy

E.

RELATED LEGISLATION

•

Alberta Election Finances and Contributions Act

•

Alberta Freedom of Information and Protection of Privacy Act

F.

RELATED DOCUMENTS

Hosting Expense Procedures – February 13, 2012

Page 7 of 7

•

Canada Revenue Agency Income Tax Bulletin – Employee Fringe Benefits

•

Purchasing Card Procedures

•

Contractual Signing Authority Procedures

•

Travel and Expense Procedures

G.

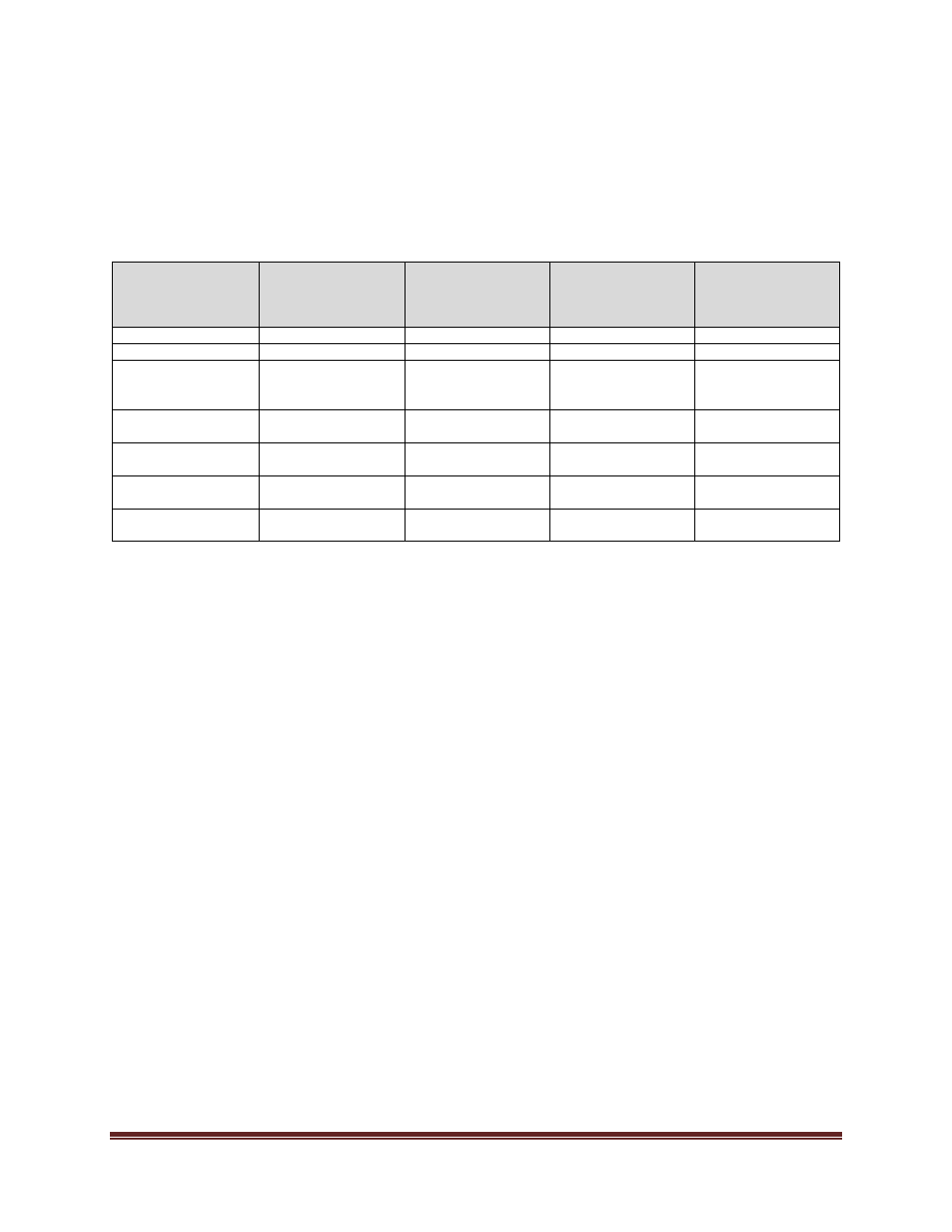

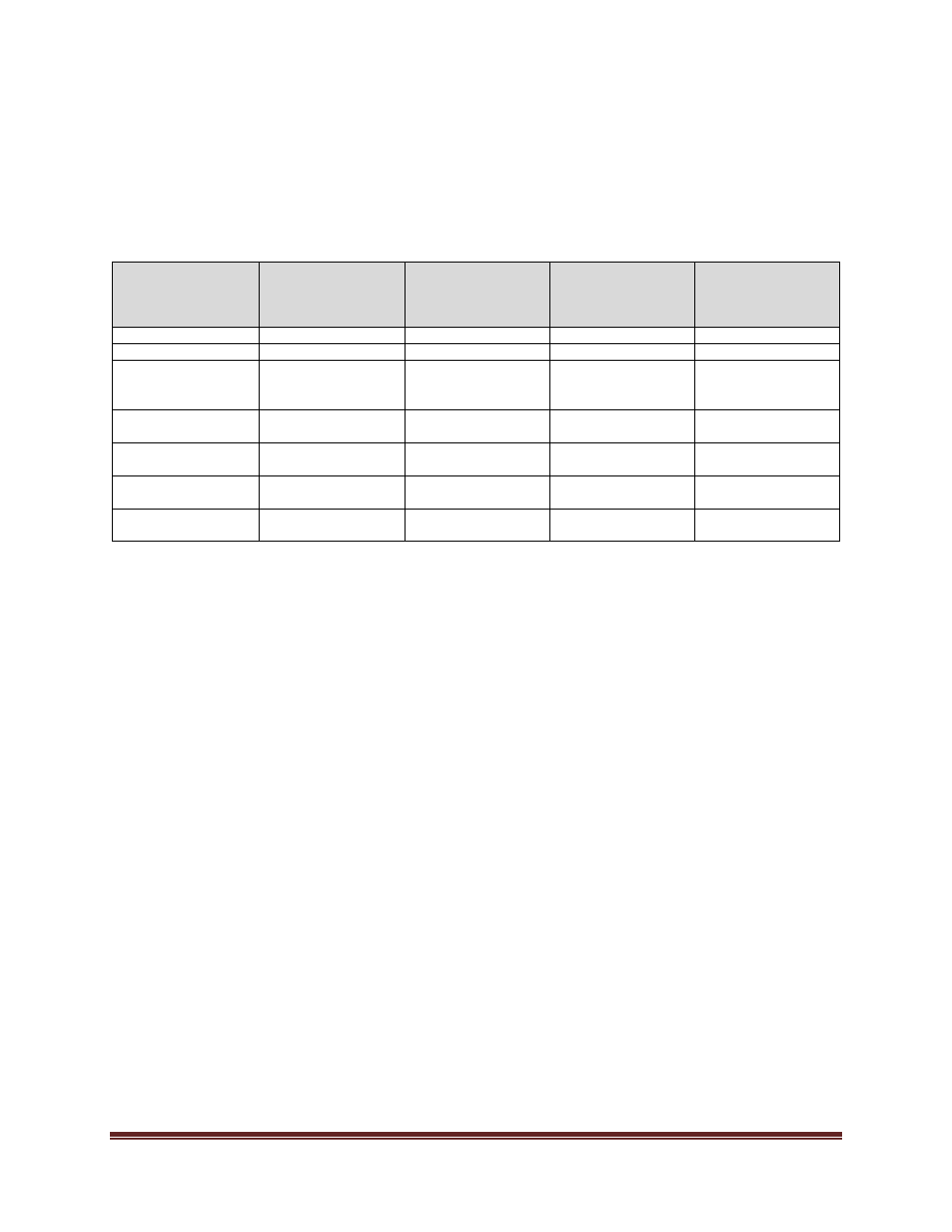

REVISION HISTORY

Date

(mm/dd/yyyy)

Description of

Change

Sections

Person who

Entered Revision

(Position Title)

Person who

Authorized

Revision

(Position Title)

01/01/2011

02/13/2012

08/24/2017

Editorial –

formatting; title and

name changes

University Secretary

08/152019

Editorial – title

changes

University Secretary

12/06/2021

Editorial – Policy

contact title

Policy Contact

Policy Advisor

General Counsel &

University Secretary

01/19/2022

Editorial

Related Policies

Policy Advisor

General Counsel &

University Secretary

04/18/2023

Editorial

Definitions

Policy Advisor

General Counsel &

University Secretary