Capital Assets Policy – May 28, 2013

Page 1 of 3

CAPITAL ASSETS POLICY

Policy Type:

Management

Initially

Approved:

May 28, 2013

Policy

Sponsor:

Vice-President,

Finance and

Administration

Last

Revised:

May 28, 2013

Primary

Contact:

AVP, Finance and

Commercial

Operations

Review

Scheduled:

May 2025

Approver:

Board of Governors

A.

OVERVIEW

Mount Royal University has internal processes and control mechanisms for the safeguarding of

its Capital Assets. Accurate records of the acquisition, valuation, Amortization, control and

disposition of all Capital Assets are maintained on an ongoing basis.

B.

PURPOSE

The purpose of this Policy is to provide direction on the acquisition, valuation, Amortization,

control and disposition of Capital Assets at Mount Royal University.

C.

SCOPE

This Policy applies to all employees and all spending activities of Mount Royal University.

This Policy applies to all Mount Royal Capital Assets, including Collections, whether purchased,

leased or received as a Gift-in-Kind.

D.

POLICY STATEMENT

1.

ACQUISITIONS

1.1 Capital Assets shall be acquired in accordance with purchasing policies and

procedures and with approved signing authority.

1.2 Funds for the purchase or lease of Capital Assets may be approved in the annual

capital budget or by using operating or restricted funds within departments.

1.3 Gifts-in-Kind received by the University may qualify as Capital Assets.

1.4 All Capital Assets purchased with University capital, operating, or restricted funds,

as well as donated Capital Assets, remain the property of the University regardless

of physical location unless otherwise stipulated under external contractual

obligation.

Capital Assets Policy – May 28, 2013

Page 2 of 3

2.

VALUATION AND AMORTIZATION

2.1 The value of Capital Assets shall include initial purchase price, taxes, design,

shipping, installation, testing, training and any other expenditure to bring the asset

to its intended location and condition for use.

2.2 Mount Royal University will use the straight-line method of Amortization over the

estimated Useful Life of the asset. Land has unlimited life and is not amortized.

3.

CONTROL

Management shall establish and maintain a Capital Asset inventory management

program to ensure validity of the Capital Assets records and the control, movement and

use of these assets.

4.

DISPOSAL OF ASSETS

Management shall control the disposition of assets deemed no longer useful to the

University.

E.

DEFINITIONS

(1)

Amortization:

is the allocation of the cost of an asset over the span of its

Useful Life

(2)

Capital Assets:

are defined as tangible property which at the time of

acquisition has a Useful Life of more than one year. For

practical purposes, Mount Royal University only records as

capital those assets which individually or as a composite asset

are valued at $5,000 or more

(3)

Collections:

are assets that usually have a lower value per unit than the

capitalization threshold, however, are treated as Capital

Assets with one combined value. Examples include library

materials and furniture.

(4)

Composite Assets:

are composed of several pieces which work together in their

service or function and collectively are valued at $5,000 or

greater

(5)

Policy:

means the Capital Assets Policy

(6)

University:

means Mount Royal University

(7)

Useful Life:

is an estimate of the length of time an asset is expected to

provide a benefit to Mount Royal University. It may, however,

provide extended use to the University well beyond this

estimate.

Capital Assets Policy – May 28, 2013

Page 3 of 3

F.

RELATED POLICIES

•

Contractual Signing Authority Policy

G.

RELATED LEGISLATION

H.

RELATED DOCUMENTS

•

Signing and Contractual Commitment Authority Procedures

I.

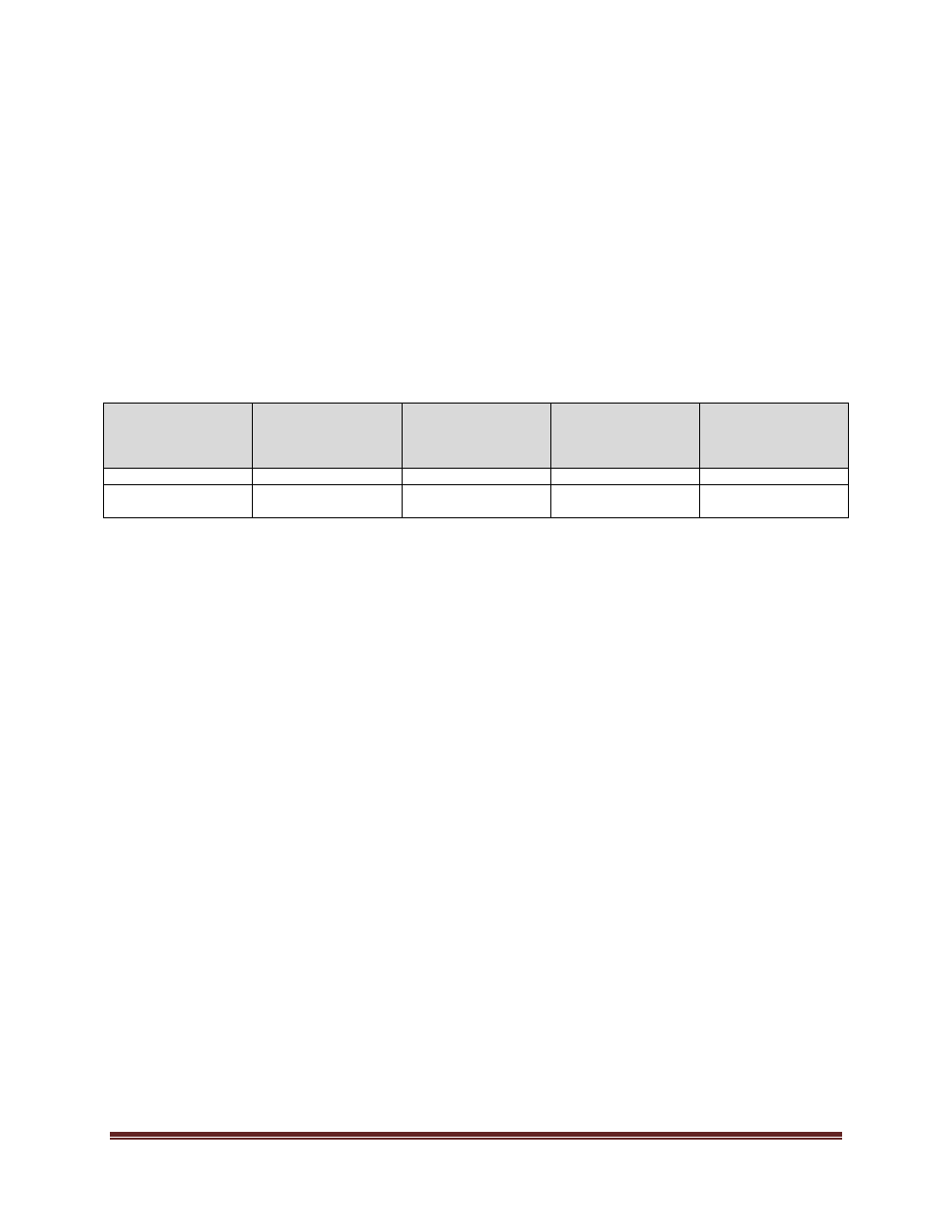

REVISION HISTORY

Date

(mm/dd/yyyy)

Description of

Change

Sections

Person who

Entered Revision

(Position Title)

Person who

Authorized

Revision

(Position Title)

05/28/2013

NEW

06/12/2021

Editorial Change –

policy contact title

Policy Contact

Policy Advisor

General Counsel &

University Secretary