Travel and Expense Policy – February 13, 2012

Page 1 of 5

TRAVEL AND EXPENSE POLICY

Policy Type:

Management

Initially

Approved:

January 1,

2011

Policy

Sponsor:

Vice-President,

Finance &

Administration

Last

Revised:

February 13,

2012

Primary

Contact:

AVP, Finance and

Commercial

Operations

Review

Scheduled:

May 2025

Approver:

Board of Governors

A.

OVERVIEW

This Policy is established to define the guiding principles for the reimbursement of travel and

business expenses incurred in the conduct of Mount Royal University (University) business by

management, faculty, staff or University-sponsored students. This Policy acknowledges the

University's status as a publicly funded institution and takes into consideration that associated

level of public accountability related to all expenditure activities of the institution.

B.

PURPOSE

1.

GENERAL

The purposes of the Travel and Expense Policy and related procedures include:

1.1

Assisting individuals to be reimbursed for expenses incurred on behalf of the

University for business and travel activities in an effective and efficient manner.

1.2

Operationalizing the University’s Travel and Expense Policy in accordance with

the necessary internal controls and accountabilities.

1.3

Ensuring expense claims are supported with proper documentation.

C.

SCOPE

This Policy and related procedures apply to all University related expenses, all employees and

students of the University, and all funds administered by the University.

This Travel and Expense Policy does not address internal or external hosting activities conducted

by University employees, students, or representatives. For all hosting activities, see the Hosting

Expense Policy.

D.

POLICY STATEMENT

1.

PRINCIPLES

The following principles are the cornerstone of managing University business travel and

reimbursement of expenses. These principles shall guide all employees and students in

achieving fair, reasonable and current practices for business, travel and expense

reimbursement.

Travel and Expense Policy – February 13, 2012

Page 2 of 5

1.1

Accountability

Create a process whereby the claimant and those with approval authority have a

clear understanding of their respective accountabilities as defined by this Policy

and related procedures.

1.2

Efficiency

Maximize the ease and efficiency in processing reimbursement claims for both

the employee and the employer.

1.3

Flexibility

Create an environment where management decisions respect the individual, best

respond to employees’ needs and interests, and consider operational

requirements in the determination of travel arrangements and expenditures for

reimbursement.

1.4

Respect and Value for People

Create a sensitive, supportive expense environment and process which

recognizes employees in a professional manner and supports the University as

an employer of choice.

1.5

Responsibility

Create an environment of responsible corporate and individual behaviour in

relation to business travel and institutional expenditures with due consideration of

risk.

1.6

Transparency

Ensure consistent, fair and equitable application of the Policy and its procedures,

demonstrating appropriate business practices in keeping with the expectations of

a publicly funded institution.

1.7

Trust

Allow discretion and latitude for employees and managers to act in a fair and

reasonable manner.

2.

POLICIES

1.1

Employees of the University, in the performance of their duties, may incur

expenses by purchasing goods and services related to business travel and

activities. The University’s Senior Executive Officers shall establish and approve

procedures to manage and guide the payment for such expenses as they relate

to authorized activities. Such approved procedures shall reflect the tone and

intention of this Policy, industry best practices, and shall be reviewed periodically.

This Policy and related procedures apply to all University business travel, all

expense reimbursements and shall apply to all funds administered by the

University.

1.2

For consideration of reimbursement or payment, each expense must be

reasonable and reflect prudence, good judgment, due diligence and be

defensible to an impartial observer.

Travel and Expense Policy – February 13, 2012

Page 3 of 5

1.3

Considering Mount Royal University's status as a publicly funded institution as

well as a registered not-for-profit charitable organization, Board members,

employees and officers of the University cannot, in their official capacity and at

the University's expense, engage in an activity that supports a political party or

candidate in public office. This prohibition extends to all indirect contributions

such as the price of admission tickets to sporting, social, or other events were

part of the proceeds are directed to a political party or candidate.

1.4

University officials or representatives are free to attend political fundraising

dinners or events as a guest. All university employees are free to attend such

events at their own expense. In the event a university official or representative

finds it necessary to purchase a ticket for business conducted on behalf of the

University, the expense will be reimbursed in accordance with the limits

stipulated in the Alberta Election Finances and Contributions Disclosure Act:

Fund-raising Functions

23(1)

In this section, "fund-raising function" includes any social function held for

the purpose of raising funds for the registered party, registered constituency

association or registered candidate by whom or on whose behalf the function is

held.

(2) The gross income from any fund-raising function must be recorded by the

chief financial officer of the registered party, registered constituency association

or registered candidate that held the function or on whose behalf the function

was held.

(3) If an individual charge by the sale of tickets or otherwise is made for a fund-

raising function held by or on behalf of a registered party, registered constituency

association or registered candidate, then for the purposes of this Act,

(a) if the individual charge is $50 or less, it shall not be considered as a

contribution unless the person who pays the charge specifically requests

that it be so considered, in which case 1/2 shall be allowed for expenses

and 1/2 shall be considered as a contribution to the registered party,

registered constituency association or registered candidate, as the case

may be, and

(b) if the individual charge is more than $50, $25 shall be allowed for

expenses and the balance shall be considered as a contribution to the

registered party, registered constituency association or registered

candidate, as the case may be.

(4) The price paid by a person at a fund-raising function in excess of the market

value at that time for goods or services received is considered to be a

contribution to the registered party, registered constituency association or

registered candidate, as the case may be.

Travel and Expense Policy – February 13, 2012

Page 4 of 5

E.

DEFINITIONS

(1)

Employee:

means individuals who are engaged to work for the

University under an employment contract, including but

not limited to faculty, staff, exempt, casual and

management employees

(2)

Employer:

Mount Royal University, the Mount Royal University

Foundation or the Mount Royal University Child Care

Centre

(3)

Expense Approver:

means the individuals holding specified positions with the

responsibility and authority to authorize expenditures. The

authority to approve Travel and Expense claims may not

be delegated below the level of Manager or Chair. For

expense claims related to professional development

activities, the appropriate signing authority is the

Department Head, Dean or Director of the respective area.

(4)

Policy:

means the Travel and Expense Policy

(5)

Student:

A student of the University currently enrolled in the

programs offered at the University.

(6)

University:

means Mount Royal University

(7)

University Business

Travel:

A person who is authorized to travel on University related

business. This may include employees, members of the

Board of Governors, students and/or representatives who

are authorized to travel on University business.

F.

RELATED POLICIES

•

Hosting Expense Policy

•

Contractual Signing Authority Policy

G.

RELATED LEGISLATION

•

Alberta Election Finances and Contributions Disclosure Act.

•

Alberta Freedom of Information and Protection of Privacy Act.

H.

RELATED DOCUMENTS

•

Canada Revenue Agency Income Tax Bulletin – Employee Fringe Benefits.

•

Expense Report Form

•

Federal Treasury Board per diem Rates

•

Hosting Expense Procedures

•

Missing Receipt Form

•

Purchasing Card Procedures

•

Travel and Expense Procedures

•

Contractual Signing Authority Procedures

Travel and Expense Policy – February 13, 2012

Page 5 of 5

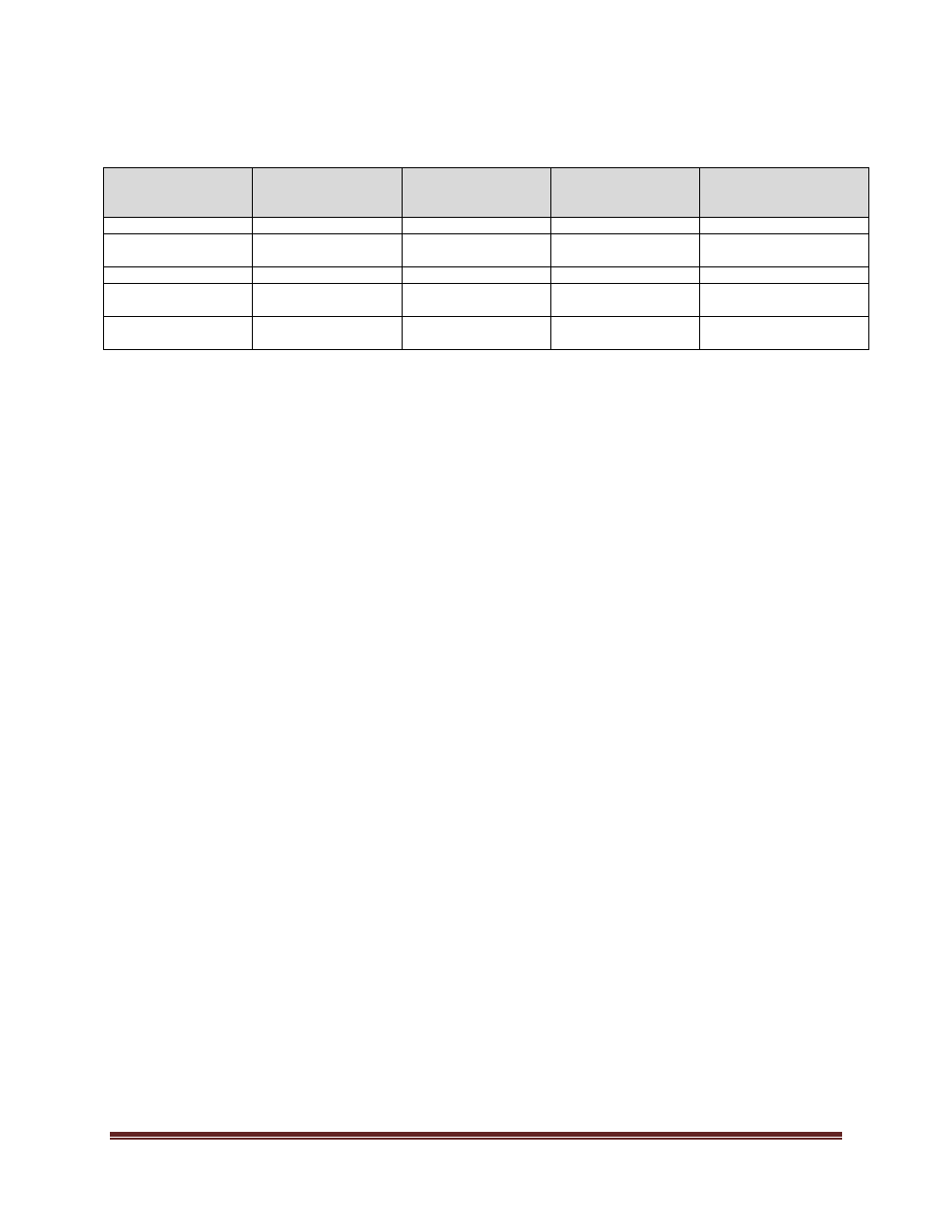

I.

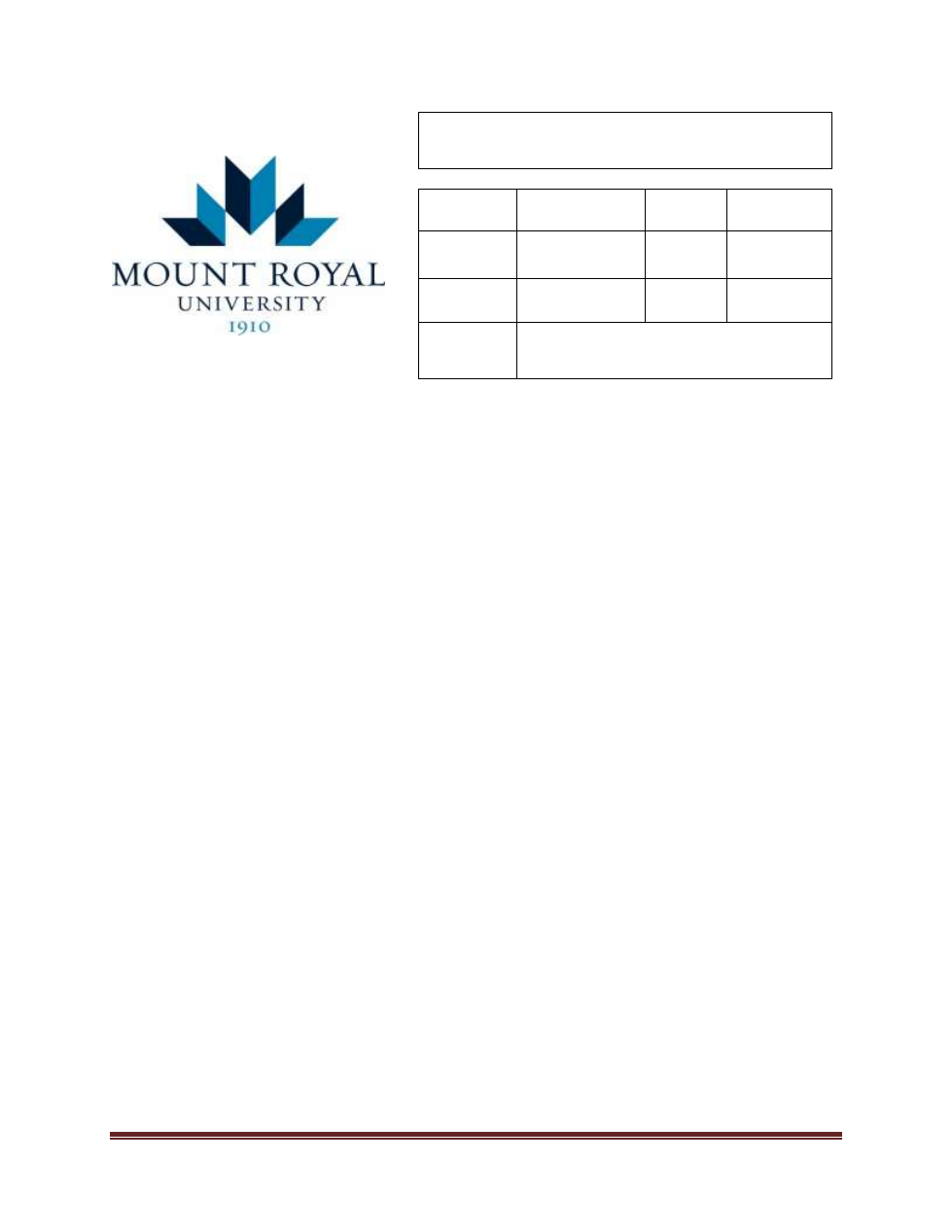

REVISION HISTORY

Date

(mm/dd/yyyy)

Description of

Change

Sections

Person who

Entered Revision

(Position Title)

Person who

Authorized Revision

(Position Title)

02/13/2012

Major revisions

08/15/2018

Editorial changes -

titles

University Secretary

01/21/2020

Editorial

Template Update

Policy Specialist

University Secretary

01/19/2022

Editorial

Related Policies

Policy Advisor

General Counsel and

University Secretary

04/18/2023

Editorial

Definitions

Policy Advisor

General Counsel and

University Secretary