Endowment Management Policy

– March 21, 2024

Page 1 of

3

ENDOWMENT

MANAGEMENT

POLICY

Policy Type:

Board

Initially

Approved:

October 26,

2007

Policy

Sponsor:

Board of Governors

Last

Revised:

March 2024

Primary

Contact:

Vice President

Finance and

Administration

Review

Scheduled:

March 21, 2027

Approver:

Board of Governors

A.

PURPOSE

Mount Royal University receives Endowment funding from donors for a variety of purposes including

student awards/scholarships/bursaries and program enrichment. The University is charged with

investing Endowment Funds in order to maximize the benefit to both current and future

beneficiaries. Responsible administrative and financial Endowment management is important in

maintaining and growing existing Endowments as well as attracting future Endowments.

B.

SCOPE

This Policy applies to all Endowments made to Mount Royal University. Compliance with University

Policies and Procedures extends to all members of the University community.

C.

POLICY STATEMENT

1.

OBLIGATION

1.1

Mount Royal University is responsible for balancing the following obligations with

regard to Endowment Funds:

a.

To protect the value of the funds against inflation, so that the income from

the funds will continue to work to the benefit of the beneficiaries.

b.

To distribute Endowment earnings in the manner specified by the donor.

c.

To provide a distribution of earnings that allows the University to plan

ahead knowing the level of funds available each year.

1.2

Decisions on the most appropriate use of unspent investment returns will be

undertaken on an annual basis and will be based upon a review of several factors

including the economic environment. Decisions to "inflation proof" the Endowments

by capitalizing a portion of unspent investment returns will be determined on an

annual basis. If it is determined that funds are available to be capitalized to inflation

proof the endowments over the long term, as a guiding principle, the University will

utilize Alberta CPI as the basis for determining the capitalized interest amount.

These retained investment returns will be available to provide increased stability to

the distributions during times of varying investment returns.

Endowment Management Policy

– March 21, 2024

Page 2 of

3

2.

CONSIDERATION WITH RESPECT TO DISTRIBUTION

In making its annual determination of the percentages to be applied to the previous fiscal

year end book value, the following factors will be taken into consideration: the current level

of Endowment distributions; the total investment returns; the Alberta CPI; and expandable

balances from prior years..

3.

DISTRIBUTION OF INVESTMENT EARNINGS

1.1

The distribution of earnings from Endowed funds will be as follows:

a.

Earnings of these funds in total will be used to cover the related expenses

of custodial and investment management fees prior to determining the

amount available for individual fund disbursement.

b.

The distribution of all other unspent earnings will be made as follows:

i.

Endowments for student awards and operating funds with a

principal balance under $30,000 or $100,000 respectively will pay

out a minimum of 3.5% of the realized investment returns on an

annual basis. Any realized returns in excess of 3.5% will continue

to be capitalized on an annual basis until the Endowment principle

reaches $30,000 or $100,000 as applicable.

ii.

Endowments for student awards and operating funds with a

principal balance in excess of $30,000 or $100,000 respectively

will pay out a minimum of 3.5% of all net realized investment

returns remaining after the annual distribution and will then be

assessed for capitalization as noted in C., 3, 1.1, d.).

c.

If the net return (realized net gains, interest, and dividends) is less than

the amounts indicated in item (b), the distribution will be based on the

actual net return and any available undistributed funds from prior years.

d.

Subject to C., 1., above, should an excess of unspent expandable funds

accumulate, capitalization may occur under the authority of the Vice-

President, Finance & Administration, and the Executive Director of the

MRU Foundation. Any unspent funds not capitalized will remain for

expenditure in the future.

e.

The recommendations on the annual distribution to recipients and any

capitalization of unspent investment returns will be prepared by the Office

of the Vice-President, Finance & Administration. The recommended

capitalization amounts will be communicated to the Finance Committee of

the Board of Governors annually and will be approved as a part of the

approval of the University's Audited Financial Statements.

4.

REVIEW

This Policy will be reviewed periodically by the Office of the Vice-President, Finance &

Administration, and recommended revisions will be forwarded to the Board of Governors

for approval on the recommendation of the Finance Committee.

D.

DEFINITIONS

Endowment Management Policy

– March 21, 2024

Page 3 of

3

(1)

Policy:

means the Endowment Management Policy

(2)

University:

means Mount Royal University

E.

RELATED POLICIES

● Investment Policy

F.

RELATED LEGISLATION

G.

RELATED DOCUMENTS

● Investment Procedures

H.

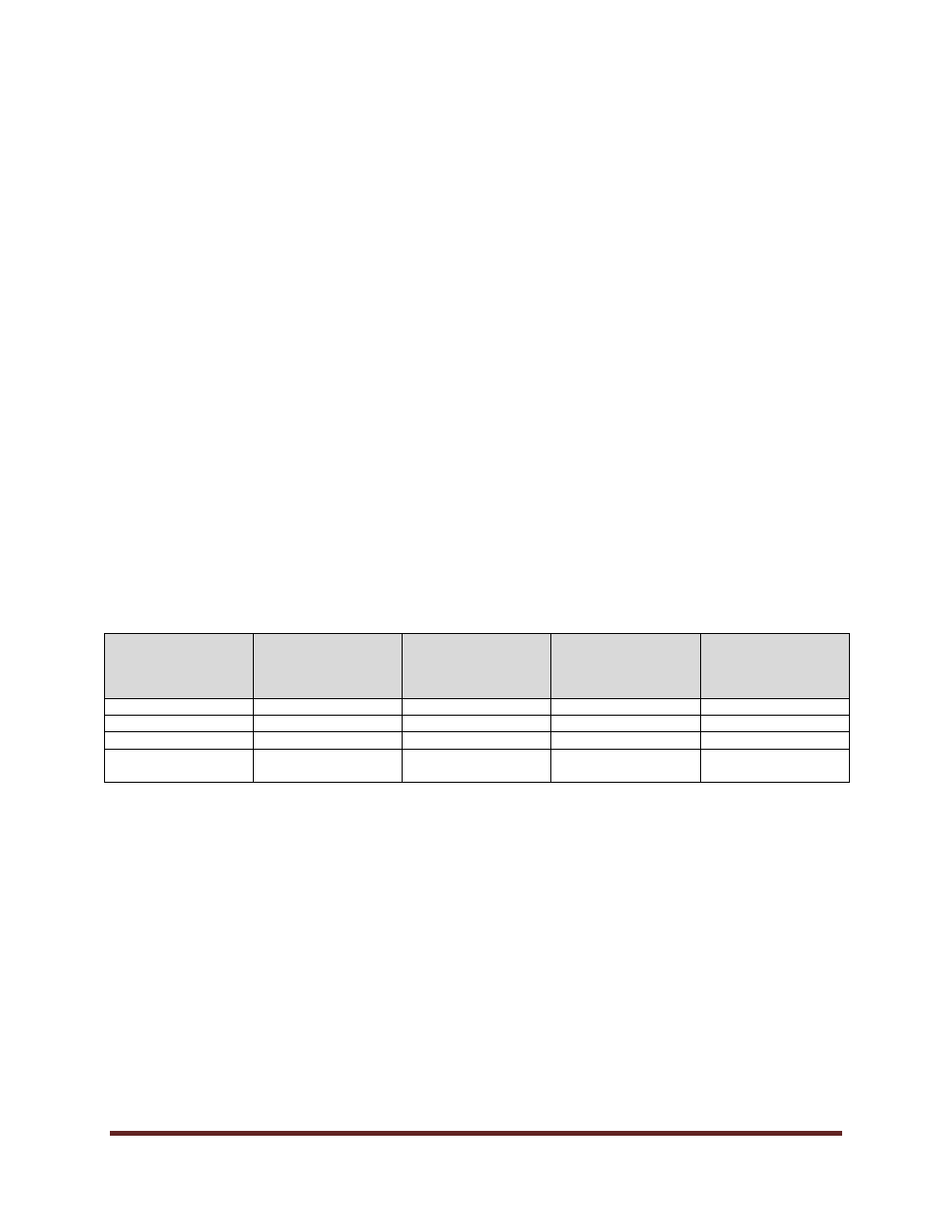

REVISION HISTORY

Date

(mm/dd/yyyy)

Description of

Change

Sections

Person who

Entered Revision

(Position Title)

Person who

Authorized

Revision

(Position Title)

04/12/2010

01/21/2020

Editorial

Template Update

Policy Specialist

University Secretary

10/13/2021

Editorial

Title Updates

03/21/2021

Major

AVP Financial

Services

Board of Governors