Investment Procedures

– December 2023

Page 1 of 5

INVESTMENT

PROCEDURES

Procedure

Type:

Board

Initially

Approved:

February 10,

2014

Procedure

Sponsor:

Board of Governors

Last

Revised:

December 2023

Administrative

Responsibility:

VP, Finance and

Administration

Review

Scheduled:

December 2025

Approver:

Executive Leadership Team

A.

OVERVIEW

Mount Royal University Investment Procedures will serve to clarify the processes required to

ensure compliance with the Investment Policy.

B.

PURPOSE

These Procedures will define the procedure(s) for measuring the investment performance of

University funds and the investment manager(s) and managing investment income.

C.

SCOPE

These Procedures extend to all funds held by the University.

D.

PROCEDURES

1.

VALUATION OF INVESTMENTS

1.1

The Investment Fund value is captured both in terms of book and market value

and denominated in Canadian dollars.

1.2

Investments in publicly traded securities and pooled funds shall be valued no less

frequently than monthly at their market value.

1.3

Investment in indexed funds comprised of publicly traded securities shall be valued

according to the unit values published at least monthly by the Manager.

1.4

If a market valuation of an investment is not readily available, then a fair value shall

be determined by the Manager. For each such non-traded investment, an estimate

of fair value shall be supplied to the Fund's Custodian and reported to the Board

no less frequently than quarterly. In all cases, the methodology utilized for

estimating fair value should be applied consistently over time.

Investment Procedures

– December 2023

Page 2 of 5

1.5

The calculation of the rate of return is to include capital gains, dividends, interest

and other income gross of all investment management expenses. The investment

return objective of investment funds is to approximate as closely as practicable the

appropriate benchmark index performance in every period.

1.6

The nature of the investment markets will change over time, and accordingly, the

Fund's objectives will be reviewed by the Board of Governors from time to time.

2.

FUND PERFORMANCE

An overall analysis of Fund performance shall be prepared and reviewed by the Board of

Governors quarterly.

3.

INCOME

The allocation of earnings will depend upon the funding restrictions. The general policy is

that all earnings will be pooled together and allocated to the University's general revenue,

with the following exceptions:

3.1.

Endowments

Income earned on endowment funds will be allocated in accordance with the Endowment

Management Policy.

3.2.

Special Purpose and Capital Funds

Earnings on special purpose and capital funds as required by funding agreements will be

allocated proportionately to each individual fund based upon its beginning quarter balance,

as required by stipulations imposed by the funding source.

3.3.

Students Investment Fund

Earnings on the Students Investment Fund, established by MRU for the educational

purposes and managed by the designated faculty and students, are allocated to the

University general fund until such time when the decision is made by the Board to allocate

it to a special purpose fund.

3.4. Supplemental Pension Plan

Earnings on the Supplemental Pension Plan for Designated Executives and Senior

Leaders of MRU will be used for the purpose of future disbursements from the Pension

Plan to its beneficiaries.

4.

SPENDING

The spending of earnings will depend upon the Fund's classification as determined in the

recording of the income. The general policy is that spending will occur based on the

requirements imposed in the University's fund classification. The following are specific

restricted fund spending policies:

4.1

Endowments

a.

Income earned on Endowments will be spent in accordance with the

specific terms and conditions of each trust.

Investment Procedures

– December 2023

Page 3 of 5

b.

Unspent income as at the end of each fiscal year will be allocated in

accordance with the Endowment Management Policy.

c.

In some years, the spending allocation made in accordance with the

Endowment Management Policy may exceed investment returns. In such

cases, the University is permitted to temporarily encroach on Endowment

funds provided the encroachment will be reversed as proceeds/funds

become available to replenish. Where such annual Endowment

encroachment occurs, management must report the same at the next

meeting of the Finance Committee and the Board of Governors; the report

should include a projection and plan for replenishment.

d.

In cases where the annual spending allocation to an individual Endowment

is insufficient to meet requirements, temporary encroachment on the

Endowment fund may be allowed with a replenishment plan where

approved by the Vice-President, Finance and Administration.

4.2

Special Purpose Funds

Expenditures will be made from Special Purpose funds only for the specific

purposes designated by the terms and conditions.

4.3

Capital Funds

Expenditures will be made from capital funds only for the specific purposes

designated by the external parties that contributed the funds.

4.4

Supplemental Pension Plan

Disbursements from Supplemental Pension Plan will be made only for funding of

the pension supplements to the persons designated as beneficiaries of such Plan.

E.

DEFINITIONS

(1)

Board/Board of

Governors:

the Board of Governors of Mount Royal University

(2)

Endowments:

donor gifts with external stipulations requiring that the principal

be held in perpetuity with earnings being spent for an intended

purpose.

(3)

Finance Committee:

the Finance Committee of the Board of Governors

(4)

Fund:

the total of all funds under management of the University.

(5)

Manager(s):

external

professional

investment

management

firm(s)

authorized and contractually engaged for investment of

University funds for specific Asset Class(es) noted within the

Investment Policy.

Investment Procedures

– December 2023

Page 4 of 5

(6)

Policy:

means the Investment Policy.

(7)

Restricted Funds:

funds with external stipulations; may require that the principal

be held in perpetuity; and, always with earnings being spent for

an intended purpose.

(8)

University:

means Mount Royal University

(9)

University Funds:

all funds held by the University, regardless of source or

purpose; in totality also referred to as the Fund

(10)

Working Capital:

unspent unrestricted funds held by the University for the

purpose of its operational activities

F.

RELATED POLICIES

● Investment Policy

● Endowment Management Policy

G.

RELATED LEGISLATION

● Alberta Post-Secondary Learning Act.

H.

RELATED DOCUMENTS

● Code of Ethics and Standards of Professional Conduct of the CFA Institute

● Endowment Management Policy Procedures

● Investment Mandate Allocation – Appendix A to the Investment Policy

● Investment Managers’ Accountability Checklist – Appendix B to the Investment Policy

● Investment Manager Mandate Statements

I.

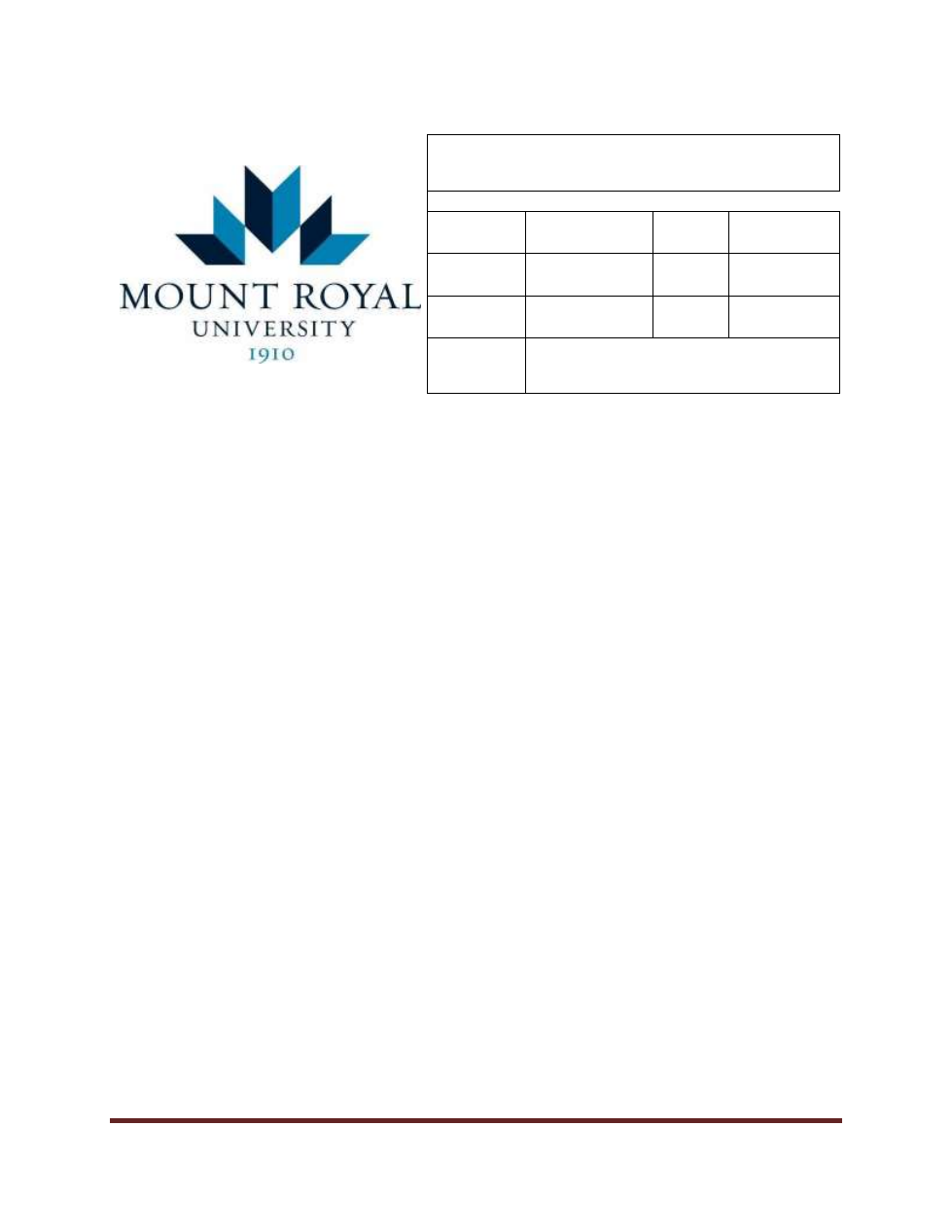

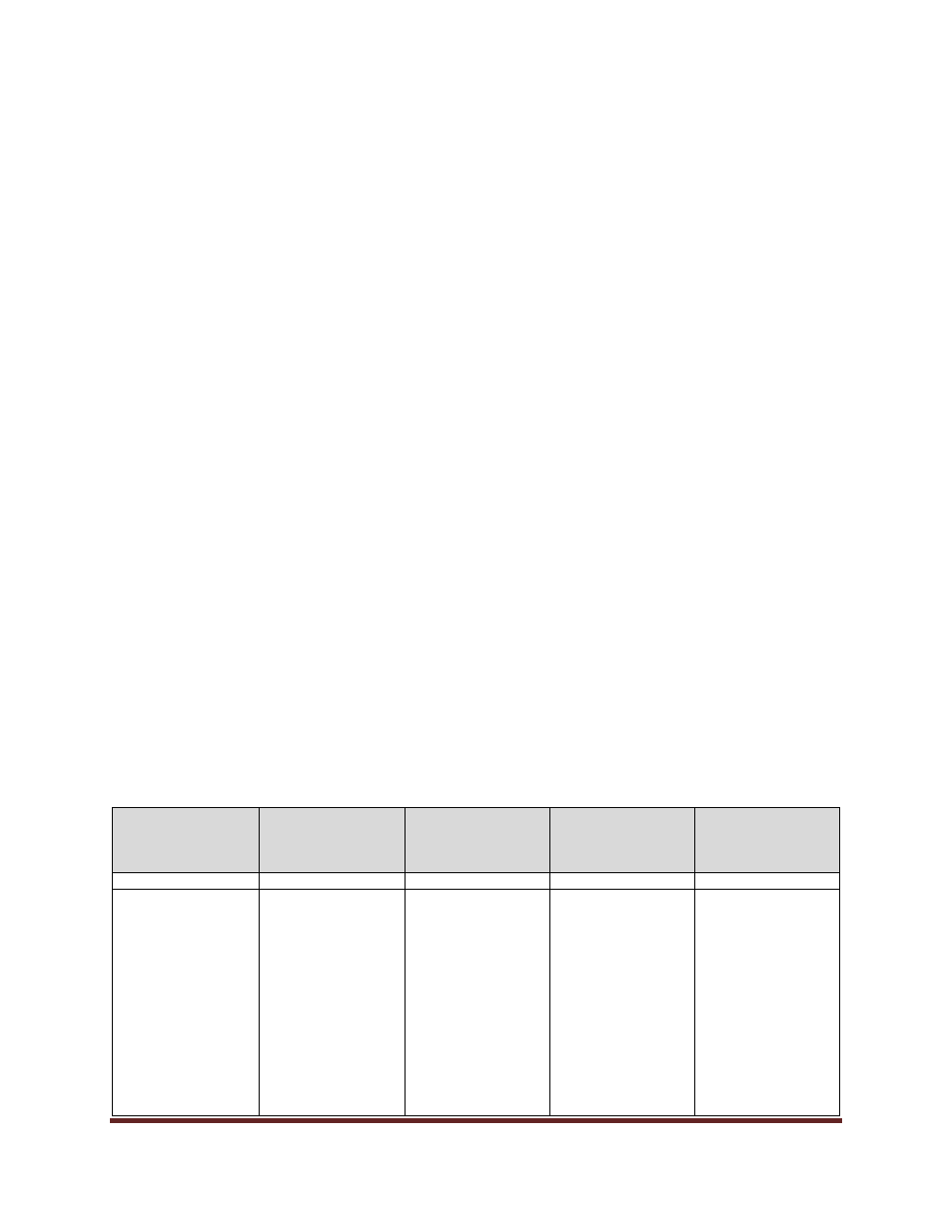

REVISION HISTORY

Date

(mm/dd/yyyy)

Description of

Change

Sections

Person who

Entered Revision

(Position Title)

Person who

Authorized

Revision

(Position Title)

02/10/2014

NEW

09/30/2021

Removed reference

to passive

management

Enhanced the

distinction between

the Long-Term

Investments and

Short-Term

Investments, as well

as the Endowed

principal and

unendowed working

capital shares of the

1.6

3

Finance Partner

AVP Finance and

Commercial

Operations

Investment Procedures

– December 2023

Page 5 of 5

Long-Term

Investment Portfolio

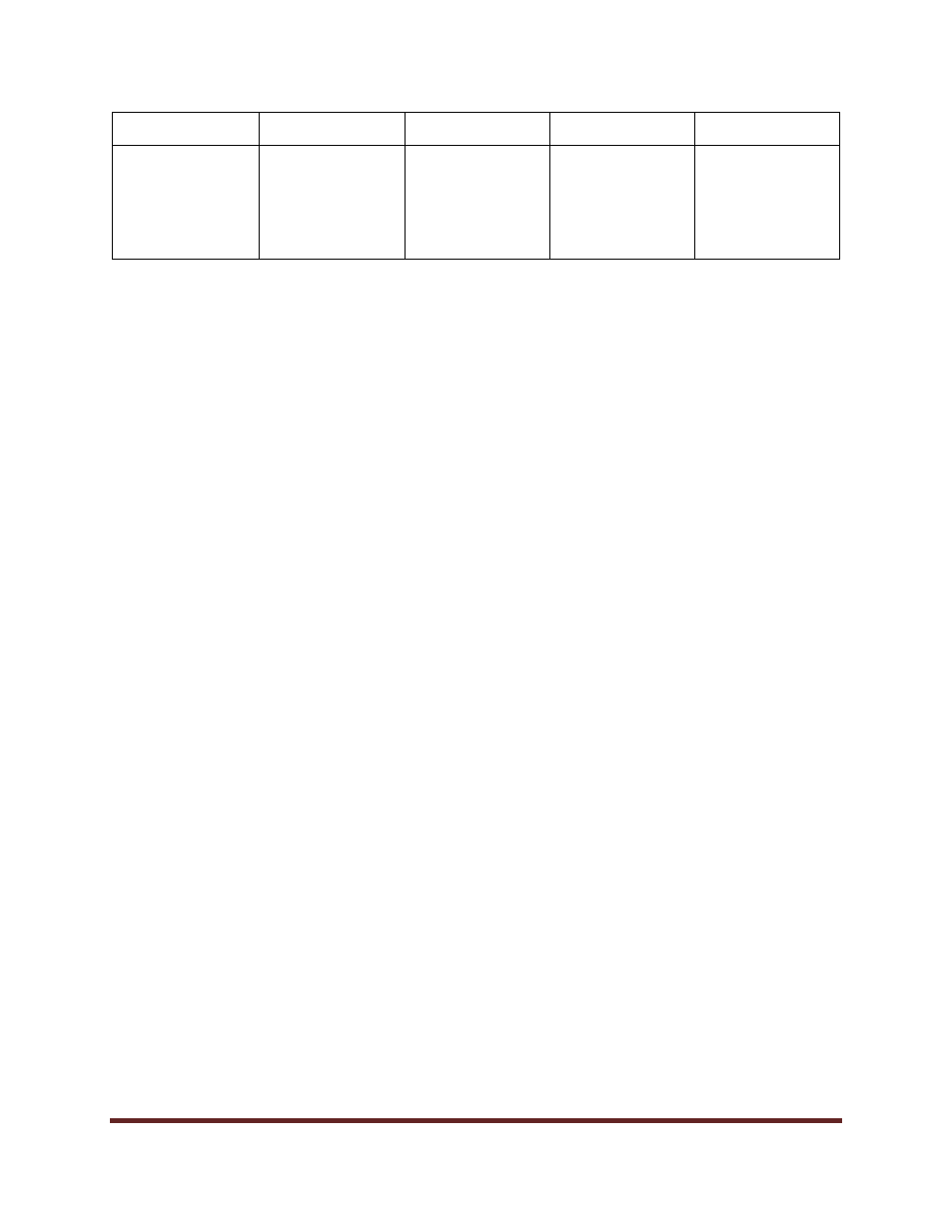

12/01/2023

Revisions to the

Procedures to bring

them in consistency

with the current

operations and the

revised Investment

Policy

C, D, F, G, H,

Finance Partner

ELT