Travel and Expense Reimbursement Procedures – February 13, 2012

Page 1 of 21

TRAVEL

AND

EXPENSE

PROCEDURES

Procedure

Type:

Management

Initially

Approved:

January 1,

2011

Procedure

Sponsor:

VP, Finance &

Administration

Last

Revised:

February 13,

2012

Administrative

Responsibility:

AVP, Finance and

Commercial

Operations

Review

Scheduled:

April 2025

Approver:

Executive Leadership Team

A.

OVERVIEW

The Travel and Expense Policy requires that all claims be reasonable, reflect prudence, good

judgment, due diligence and be defensible to an impartial observer. The impartial observer to whom

we, as a public institution, can anticipate having to defend the reasonableness of our claims may

include: auditors, internal or external, representing any of the funding organizations that support

activities at the University and Provincial level; members of the public; and any form of media who

wish to scrutinize specific activities by query or through the means offered in the Government of

Alberta's Freedom of Information and Protection of Privacy Act.

B.

PURPOSE

Based on the principles stated in the Travel and Expense Policy, the purpose of this document is

to ensure fair treatment of employees required to travel and incur expenditures on behalf of the

University. The provisions contained in this document are mandatory and provide for the payment

of reasonable expenses necessarily incurred on University business and to ensure employees are

appropriately reimbursed; and, direct the appropriate considerations and authority for travel and

related expenditures, taking into consideration the expectations of a publicly funded institution.

C.

PROCEDURES

1.

ADMINISTRATION

1.1

Authorization

a.

The Expense Approver of the Employer have the responsibility to

authorize and determine when business travel is necessary and to ensure

that all travel arrangements are consistent with the principles of the Travel

and Expense Policy and as spelled out in this document. Following

consultation between the Expense Approver and the Employee, the

determination of travel arrangements shall best accommodate the

Employee's needs and interests and the Employer's operational

requirements.

b.

The review and approval of expense claims is to be carried out by Deans,

Directors, Department Heads, or designated Managers/Chairs for each

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 2 of 21

respective area. These individuals have the authority and are responsible/

accountable for determining the overall reasonableness of the claims and

for making exceptions to the normal guidelines when circumstances

warrant such action. All exceptions are to be in keeping with the guiding

principles of this Policy. In all circumstances, reimbursement claims must

be approved by one administrative level higher than the claimant (one-

over approval).

c.

Reports and reimbursement claims for expenses incurred by the President

require both the review and approval of the Vice-President, Finance and

Administration as well as the approval of the Chair of the Board of

Governors.

1.2

Traveller Responsibilities

The traveller shall:

a.

Become familiar with and adhere to the provisions of these procedures;

b.

Consult and obtain prior authorization to travel in accordance with these

procedures;

c.

Where travellers have special needs requiring incremental travel costs,

provide written communication to the employer requesting approval for

such incremental costs;

d.

Complete and submit travel expense claims with necessary supporting

documentation by the latter of: 10 days following the completion of the

travel, or the next corporate credit card due date. In travel situations

exceeding one month, the traveller may submit interim travel expense

claims prior to the completion of the travel;

e.

Be responsible for cancelling reservations as required, safeguarding travel

advances and funds provided, and making outstanding remittances

promptly;

f.

Where reimbursements have been made in advance of travel activities

(airfare, registration, accommodation, etc.), and that activity is cancelled

for any reason, advise their Expense Approver of such cancellation,

refund the University those monies in full and retain any credits for future

University related business; and,

g.

Report the loss of any University owned assets or equipment and report

any damage to University vehicles immediately to Security Services. Such

a report must not wait until the traveller’s return.

1.3

Receipts

a.

Where a reimbursement claim is for an expense other than a stated

allowance (see Appendix A), a detailed receipt is required to support the

request for reimbursement.

b.

Where the traveller certifies that the receipt was lost, accidentally

destroyed or unobtainable, an individual claiming the expenditure must

indicate the receipt as not available on the expense claim form. Further,

that individual must fully complete all expenditure details on the "Missing

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 3 of 21

Receipt Form." The Expense Approver then is responsible for signing and

submitting this Missing Receipt Form with the related expense claim.

1.4

Use of Corporate Credit Cards While on Travel

a.

Where available, employees may use Mount Royal University Credit

Cards (see the Corporate Credit Card Policy) for the following travel

related expenditures: airfare and transportation costs; accommodation;

and registration for conferences and workshops.

b.

For the efficiency of expense claim processing and to avoid both the

traveller and the Expense Approver having to face the complexity of

reconciling actual payments of and the allowance available for individual

meals, personal meals consumed while on business travel are not to be

charged to the Corporate Credit Card unless absolutely unavoidable.

c.

Travellers are encouraged to settle hotel bills separately: the room and all

direct, eligible expenses on the Corporate Credit Card and all personal

expenses, including meals, alcohol, incidental or personal services by

personal payment for subsequent reimbursement. Personal meals while

on University related travel are reimbursed through claiming up to the

maximum for eligible per meal allowances -- see Appendix A. Individuals

are encouraged to request travel advances for such expenditures as

needed.

1.5

Travel Advances

a.

Employees may require a cash advance to cover meals, taxi and incidental

expenses by submitting an approved “expense report” for such travel

advance to Finance and Commercial Operations at least 10 working days

prior to the intended departure.

b.

Within 10 working days following return from the applicable travel, an

expense report form must be submitted to the Financial Services and

Commercial Operations through the appropriate supervisor, attaching

appropriate detailed receipts for expenses incurred.

c.

If expenses are less than the amount of the original advance, a cheque

payable to Mount Royal University must be attached with the authorized

expense report for the difference. If expenses are in excess of the original

advance, the Employee will be reimbursed for the difference upon process

of the authorized expense report.

d.

Where travel advances remain outstanding and have not been cleared as

per C., 1, 1.5, a., of this procedure, supplementary travel advances may

be withheld by Finance and Commercial Operations in consultation with

the Expense Approver until all prior advances are cleared with submission

of completed approved travel expense reports.

1.6

Travel Forms

a.

University approved travel forms shall be used in seeking business travel

authority and submitting travel claims with the supporting documentation

where necessary.

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 4 of 21

b.

All expenses for a single event/trip should be submitted on one form

whenever possible.

1.7

Overpayments

Overpayments, namely amounts reimbursed or paid to travellers in excess of

eligible and approved costs, shall be recovered from the traveller as a debt owing

to the university.

1.8

Third Party Travel Regulations

When external granting agency regulations differ from the university regulations,

and the funding agreement explicitly requires that their regulations apply to all

activities carried out therewith, the agency’s regulations shall take precedence.

1.9

Loyalty Programs

Individuals may join loyalty programs and retain benefits offered for business or

personal use provided that there are no additional costs to the University. If an

Employee is using any form of affinity card (i.e., AirMiles, Aeroplan, etc.) for

University expenditures, it is the Employee’s responsibility to declare a taxable

benefit upon redemption of their affinity points earned from employer paid

expenses per tax legislation as dictated by Canada Revenue Agency (CRA) under

Income Tax Bulletin – IT470R – Employee Fringe Benefits.

2.

GENERAL PROVISIONS

2.1

General Travel and Expense Provisions

The following general provisions apply to all travel and related expense claims and

to non-travel, business related expenses incurred.

Note Section C., Additional Specific Provisions: Following these general

provisions provide the incremental provisions, given the nature of respective type

of expense or travel there described.

2.2

Pre-Travel Authorization

Prior to the commencement of travel, the travelling Employee must ensure they

have acquired approval from the appropriate Expense Approver for the travel being

undertaken. Such approval shall include information on the purpose, destination,

duration of required travel, mode of transportation and address any anticipated

exceptions to travel allowances.

2.3

Meals and Incidental Expense Allowances

a.

A traveller shall be paid the appropriate meal allowance for each breakfast,

lunch and dinner while on approved travel unless the meal is otherwise

provided.

b.

Meal allowances shall be reimbursed in accordance with the rates

specified in Appendix A. A meal allowance shall not be paid to a traveller

with respect to a meal that is provided. In exceptional situations (e.g.,

dietary restrictions) where a traveller has incurred personal expenses to

supplement meals provided or the traveller incurs meal costs which are

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 5 of 21

higher than the established meal allowances in situations outside the

traveller’s control, the actual incurred costs may be reimbursed, based on

detailed receipts.

c.

As an exception, a reasonable daily comprehensive allowance may be

authorized in circumstances where established allowances are not

deemed practical, reasonable or equitable. Such arrangements are to be

approved in advance of travel with the appropriate Expense Approver(s).

d.

A traveller shall be paid an incidental expense allowance that covers a

number of miscellaneous expenses not otherwise provided for in this

document for each day or partial day of approved travel as per Appendix

A. A partial day does not include days where a late-night flight arrives in

the traveller's home area after midnight.

e.

Under certain circumstances, meal expenses not associated with travel,

based on detailed receipts, may be reimbursed up to the limit of the

applicable meal allowance in Appendix A, provided reimbursement of meal

expenses is clearly reasonable and justifiable as a direct result of an

Employee's duties away from the workplace and as approved by the

Expense Approver.

f.

Receipt-based meal reimbursement shall not include reimbursement for

the meals of any persons other than the individual making the claim, nor

for alcoholic beverages unless as set out in the Hosting Expense Policy.

2.4

Transportation

a.

The selection of the mode of transportation shall be based on cost,

duration, convenience, safety and practicality.

b.

Temporary austerity measures in place until further notice.

The standard for air travel is Economy Class. Anything beyond that

requires special approval as outlined in the Travel and Expense

Reimbursement Procedures, C., 2, 2.4, c., ii.

If travel circumstances allow, individuals are encouraged not to incur fees

for advances seat selection, preferred seats, etc. However, these fees are

considered as an acceptable business expense.

No additional baggage fees (except one checked item + acceptable carry-

on) unless travel > 7 days or carrying materials required by MRU such as

a trade show display case.

The use of limousines and town car services should only be used in

exceptional circumstances.

c.

Commercial

i.

Where commercial transportation is authorized and used, the

traveller shall be provided with the necessary prepaid tickets

whenever possible.

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 6 of 21

ii.

The standard for air travel is Economy Class. The lowest available

airfares appropriate to particular itineraries shall be sought and

bookings shall be made as far in advance as possible.

iii.

Under extraordinary circumstances, the length of time in travel

followed with work-related obligations immediately upon arrival

may justify a request for a business class flight. Approval for all

business class flights is required from the Division Head, the

President or the Chair of the Board of Governors, whichever

appropriate.

iv.

Taxis, shuttles and local transportation services including rail are

alternatives to rental vehicles for local trips. Actual expenses shall

be reimbursed, based on detailed receipts. Detailed receipts are

only required to justify transportation fares in excess of $10.

d.

Rest Periods

i.

For the personal wellness of the employee, appropriate rest is

encouraged. Unless mutually agreed otherwise, itineraries shall

be arranged to provide for an overnight stop after travel time of at

least nine consecutive hours. Travel time is the time spent in any

mode of transportation en-route to destination and/or awaiting

immediate connections. This includes the time spent travelling to

and from a carrier/terminal.

ii.

The University discourages the use of overnight flights on

business travel.

e.

Vehicles

i.

For business travel purposes the use of rental vehicles is preferred

and the use of personal vehicles is strongly discouraged. Under

specific circumstances, the traveller’s Expense Approver may

authorize the use of the traveller’s personal vehicle. The

reimbursement, however, shall be limited to the lower of the cost of

a mid-size rental vehicle, commercial coach, or reimbursement of

the kilometer rate per kilometers driven as per Appendix A.

ii.

The standard for rental vehicles is mid-size. Rental vehicles

beyond the standard shall be authorized based upon factors such

as but not limited to safety, the number of passengers, the needs

of the traveller and the bulk or weight of goods transported.

Employees renting vehicles shall arrange rental insurance with a

minimum of $2 million for liability and collision insurance.

iii.

The kilometric rates payable for the use of privately owned vehicles

driven on authorized University business are prescribed in

Appendix A. Travellers shall use the most direct, safe and practical

road routes and shall claim only for distances necessarily driven on

University business travel.

iv.

In the interests of the health and safety of the traveler on University

business, employees shall not normally be expected to drive more

than:

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 7 of 21

250 kilometers after having worked a full day;

350 kilometers after having worked one-half day; or

500 kilometers on any day when the employee has not

worked.

v.

Where the business travel involves the employee driving in excess

of three hours of travel one way, he/she is encouraged to use

overnight accommodation and return the following day.

vi.

Travellers who are driven to or picked up from an airport terminal

shall be reimbursed the kilometric rate based on the distance to

and from the airport terminal for each round trip.

vii.

Parking charges shall be reasonably reimbursed where it is

practical and economical to leave a personal/private vehicle at the

airport or bus terminal during the period of absence. Detailed

receipts are only required to justify transportation fares in excess

of $10.

viii.

In respect of every day on which an employee is authorized to use

a personal/private vehicle on University business travel, the

employee shall be reimbursed the actual costs of parking the

vehicle for that period of time.

f.

Other Modes of Transportation

i.

In addition to provisions outlined in this section under commercial

or, expenses associated with the selected mode of transportation

such as bus, coach, ferries, and tolls shall be reimbursed based

upon original receipts. Detailed receipts are only required to

justify transportation fares in excess of $10.

ii.

When authorized travel or overtime causes a disruption in the

employee's regular commuting pattern, the employee shall be

reimbursed actual additional transportation costs incurred

between the residence and the workplace.

2.5

Accommodation

a.

Accommodation is provided for business travel where an overnight stay is

involved in the approved travel or necessitated by events beyond the

control of the traveler while on approved University business.

b.

The standard for accommodation is a single room, in a safe environment,

conveniently located and comfortably equipped.

c.

A variety of options for accommodation are available for travel. Generally

these include hotels, motels, corporate residences, apartments, and

private non-commercial accommodation.

d.

Although travellers generally stay in commercial accommodation, private

non-commercial accommodation is an alternative. A traveller who chooses

private non-commercial accommodation shall be reimbursed the rate as

specified in Appendix A. Where a traveller chooses private non-

commercial accommodation, those costs including ground transport

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 8 of 21

incurred as a result of that choice must not exceed the cost of commercial

accommodation.

e.

For periods of business travel that is scheduled to exceed 14 consecutive

calendar days at the same location, accommodation at corporate

residences, apartments, private non-commercial accommodation or

University and institutional accommodation is encouraged. Travellers who

choose to stay in a hotel for any part of business travel which is scheduled

to exceed 14 consecutive calendar days at the same location when

apartments or corporate residences are available in the area surrounding

the workplace, shall be reimbursed up to the cost of the average apartment

or corporate residence available.

2.6

Travel Exceeding 14 Consecutive Calendar Days

Where business travel is scheduled to exceed 14 consecutive calendar days of

approved travel while at the same location when corporate residences or

apartment hotels are available to a traveller in the area surrounding the workplace,

or the traveller chooses to stay in private accommodation, the following exception

applies: 75% of allowances as specified in Appendix A shall be paid.

2.7

Non-Work Time Within Continuous Work Required Travel Itinerary

Where an Employee’s itinerary include periods of time without work related duties

within a work required period of continuous approved travel, the travelling

Employee shall be reimbursed for the accommodation and the appropriate meal

and incidental expense allowances but shall not be eligible for reimbursement

related to any activities taken at the individual’s discretion. Any personal activities

during the period of approved travel are undertaken at the Employee’s individual

expense.

2.8

Additional Business Expenses on University Travel

a.

The Employee shall be reimbursed reasonable business expenses not

otherwise covered such as, but not limited to business calls, photocopies,

word processing service, faxes, internet connections, rental and

transportation of necessary office equipment and transportation of work

required personal effects. All such services for which reimbursement is

requested shall be at reasonable and competitive rates. Goods and

services for which reimbursement is requested shall be at reasonable and

competitive rates and be supported by original receipts.

b.

The University has a variety of international standard telecommunications

equipment available for the use of travellers. Travellers are responsible to

request the use of such equipment from the University Information

Technology Services office. Where the necessary equipment is not

available to the traveller for the dates required, reasonable expenses shall

be eligible for reimbursement for expenditures such as business calls,

photocopies, word processing service, faxes, internet connections, rental

and transportation of necessary office equipment and transportation of

work-required personal effects. Where the Employee must travel through

regions where water is deemed unsafe for drinking, the cost of bottled

water will be reimbursed. All such services for which reimbursement is

requested shall be at reasonable and competitive rates.

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 9 of 21

c.

Employees whose schedules have been altered for reasons outside their

control shall be reimbursed reasonable telephone costs and/or internet

connections to attend to situations related to the Employee's altered

schedule.

d.

When an Employee is required to proceed outside Canada on authorized

University business, the employee shall make the necessary

arrangements and subsequently be reimbursed (excluding fees for

passports) for obtaining the appropriate travel documents required for the

destination(s) and required inoculations, vaccinations, X-rays and

certificates of health.

2.9

Dependant Care

a.

The Employee who is required to travel on University business involving

an overnight stay shall be reimbursed actual and reasonable dependant

care expenses up to a daily allowance of $35 Canadian, per household,

with a declaration, or up to a daily allowance of $75 Canadian, per

household, with a receipt when:

i.

The Employee is the sole caregiver of a dependant who is under

18 years of age or has a mental or physical disability, or

ii.

Two employees living in the same household are the sole

caregivers of a dependant who is under 18 years of age or has a

mental or physical disability and both employees are required to

travel on University business at the same time.

b.

Dependant care allowance shall apply only for expenses that are incurred

as a result of travelling and are additional to expenses the Employee would

incur when not travelling. Where the dependant care is required for more

than one individual or involving acute care, the traveller should advise their

Expense Approver in advance of travel of the actual incremental cost

anticipated for the duration of travel. The Expense Approver will then

review this incremental cost and provide pre-approval for reimbursement

beyond the allowance set above.

2.10

Insurance

See Appendix B – Insurance.

2.11

Items Not Eligible for Reimbursement

a.

Examples of expenses not eligible for reimbursement under any provision

for travel or expense claim, may include but are not limited to:

i.

Credit card interest charges;

ii.

Fines for parking and/or traffic violations.

3.

ADDITIONAL SPECIFIC PROVISIONS

3.1

Expenses Incurred Within Calgary

a.

In addition to the General Provisions set out in Section 2, the specific

provisions outlined below apply when an Employee is away from the

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 10 of 21

workplace on University business or business travel within Calgary or

when the Employee must use their own resources in acquiring approved

goods or services and the preferred method of payment is not available or

accepted by the vendor.

b.

The preferred method of payment for purchase of small dollar goods and

services for University business is a University Corporate Credit Card or

P-card.

c.

Meals

i.

Unless otherwise covered by terms and conditions of employment

or collective agreements, meal expenses incurred within Calgary

shall not normally be reimbursed.

ii.

Under certain circumstances meal expenses not associated with

travel, may be reimbursed up to the limit of the applicable meal

allowance in Appendix A when the reimbursement of meal

expenses is clearly reasonable and justifiable as a direct result of

an Employee's duties away from the workplace and as approved

by the Expense Approver.

iii.

Receipt-based meal reimbursement shall not include

reimbursement for alcohol unless as set out in the Hosting

Expense Policy.

iv.

Reimbursement of meals for shift workers shall be based on the

meal sequence of breakfast, lunch and dinner, in relation to the

commencement of the employee's shift.

d.

Transportation

i.

Local transportation services (transit, taxis, shuttles, commercial

coaches, etc.) are alternatives to vehicle rental for local trips. Actual

expenses shall be reimbursed. Detailed receipts are only required

to justify transportation fares in excess of $10.

ii.

Use of Personal/Private Vehicle

- Employees authorized to use a

personal/private automobile on University business shall be

reimbursed at the rates outlined in Appendix A. Travellers shall

use the most direct, safe and practical road routes and shall claim

only for distances necessarily driven on University business-related

travel. In the application of the reimbursement rate to kilometers

driven, the travel will be deemed to be commencing from and/or

terminating at the normal place of business at the University on the

Employee’s normal days of business, and deemed to be

commencing from and/or terminating at the Employee’s place of

residence on days outside of the employee’s normal days of

business.

iii.

Employees using their vehicles on University business are

responsible to ensure that their insurance company is aware of the

exact nature and extent of University business travel and to ensure

they hold the appropriate operating license (driver’s license) for the

nature of their business travel.

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 11 of 21

e.

Business Expenses

The Employee shall be reimbursed reasonable business expenses not

otherwise covered such as, but not limited to, photocopies, work

processing service, faxes, internet connections, rental and transportation

of necessary office equipment and transportation of work-required

personal effects. Goods and services for which reimbursement is

requested shall be at reasonable and competitive rates, and be supported

by original receipts.

3.2

Travel to the U.S.A.

In addition to the General Provisions set out in Section 2, the specific provisions

outlined below apply when a traveller is away from the workplace on University

business travel overnight in the U.S.A.

a.

Currency exchange

i.

The costs incurred in converting sums to foreign currencies and/or

reconverting any unused balance to Canadian currency shall be

reimbursed, based upon detailed receipts, from all transactions

and sources.

ii.

When these costs are not supported by detailed receipts, the

average Bank of Canada currency exchange rate shall apply. In

cases where the Bank of Canada does not provide an exchange

rate, an alternate bank rate from an established institution, as

determined by the Employer, shall be applied. The rate shall be

the average of the rates applicable on the initial date into the

country and the final date out of the country.

b.

Meal and Incidental Expense Allowances

Allowances for meals and incidental expenses are paid in the value equal

to the same allowances in U.S. funds when traveling in the United States

of America.

3.3

International Travel – Outside Canada and the U.S.A.

In addition to the General Principles set out in Section 2, the specific provisions

outlined below apply when a traveller is away from the workplace on University

business travel, outside Canada or the U.S.A.

a.

Currency Exchange

i.

The costs incurred in converting reasonable sums to foreign

currencies and/or reconverting any unused balance to Canadian

currency shall be reimbursed, based upon detailed receipts, from

all transactions and sources.

ii.

When these costs are not supported by detailed receipts, the

average Bank of Canada currency exchange rate shall apply. In

cases where the Bank of Canada does not provide an exchange

rate, an alternate bank rate from an established institution, as

determined by the Employer, shall be applied. The rate shall be

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 12 of 21

the average of the rates applicable on the initial date into the

country and the final date out of the country.

b.

Meal and incidental Expense Allowances

Meal and incidental expense allowances shall be reimbursed in

accordance with the rates specified in Appendix A. As an exception, a

reasonable daily comprehensive allowance may be authorized in

circumstances where established allowances are deemed insufficient,

unreasonable or inequitable. Such arrangements are to be approved in

advance of travel with the appropriate Expense Approver(s). Note: When

making reference to the Federal Treasury Board per diem rates for

international travel, it is their “traveller”, and not their “employee” rates that

apply for the University’s activities.

c.

Transportation

i.

Vehicles

The use of rental vehicles while on international travel (outside

Canada the U.S.A.), is not recommended. If upon the assessment

of specific circumstances, approval for a rental vehicle is provided,

the general provisions for rental vehicles apply.

4.1

Emergencies, Illnesses and Injuries While on Approved Travel

a.

Payment for the use of a suitable transportation, such as an ambulance or

taxi, may be authorized where an Employee becomes ill or is injured when,

in the opinion of the Employer, the Employee, or the attending medical

practitioner, the nature of the illness or injury requires that the Employee

be transported to a medical treatment facility, the travel-related

accommodation, or home.

b.

An Employee shall be reimbursed the necessary expenses incurred as a

result of illness or accident occurring while on approved travel, to the

extent that the Employer is satisfied the expenses were additional to those

which might have been incurred had the Employee not been absent from

home, and which were not otherwise payable to the Employee under an

insurance policy.

c.

An Employee who becomes ill or is injured while outside Canada shall,

where practical, be provided with a justifiable, accountable advance when

incurring sizeable medical expenses. Such advances would subsequently

be repaid to the Employer under the Employee's private insurance plans.

d.

When, in the opinion of the attending physician, an Employee's condition

resulting from illness or injury warrants the presence of a representative of

the family, actual and reasonable travel expenses may be reimbursed, as

if that person were an Employee.

e.

An Employee may be authorized to return earlier than scheduled as a

result of the illness, accident or death or an immediate family member, or

in the event of emergency situations at home (e.g. serious illness in the

opinion of a physician, fire, flood, ice storm, or natural disaster).

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 13 of 21

f.

When a trip home for reasons specified in this section is not warranted,

actual and reasonable expenses incurred for long-distance telephone calls

home shall be reimbursed.

4.2

Death While on Approved Travel

a.

If an Employee dies while on approved travel, the Employer shall authorize

the payment of necessary expenses that are additional to those which

might have been incurred had the death occurred at the Employee’s home

location. Reimbursement of costs incurred shall be reduced by any

amount payable under some other authority. Expenses payable may

include:

i.

At the place where death occurred: ambulance, hearse,

embalming/cremation, outside crate/container (but not the cost of

a coffin/urn) and any other services or items required by local

health laws, and

ii.

transportation of the remains to the normal home location or, if

desired by the survivors, to another location, up to the cost of

transportation to the normal home location. Costs for an escort

over and above the costs included in transporting the remains are

payable only when an escort is required by law.

b.

Where the remains are not transported, travel for a representative of the

family to the place of burial shall be reimbursed as though that person

were an Employee.

D.

DEFINITIONS

(1)

Accommodation:

Commercial accommodation - lodging facilities such as

hotels, motels, corporate residences or apartments.

University accommodation - University residences as

well as other sleeping accommodation provided by

educational institutions.

Private non-commercial accommodation - private

dwelling or non-commercial facilities where the traveller

does not normally reside.

(2)

Alcohol:

All alcoholic beverages. All provisions and consumption of

alcohol on the Mount Royal University premises must be in

compliance with the law.

(3)

Allowance:

Individual allowances provided to cover the costs of specific

meals not otherwise provided, incidental expenses, use of

a private or personal vehicle or private, non-commercial

accommodation.

(4)

Comprehensive

Allowance:

A daily allowance that may include some or all of individual

meal costs, incidental expenses, transportation costs and

accommodation expenses.

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 14 of 21

(5)

Declaration:

A written statement signed by the traveller attesting to and

listing the expenses for payment without receipt.

(6)

Dependant:

Person who resides full-time with the employee at the

employee’s normal place of residence, i.e.: spouse, child,

dependent parent or grandparent, etc.

(7)

Economy Class:

The standard class of air travel. This excludes first class

and business class or equivalents.

(8)

Employee:

means individuals who are engaged to work for the

University under an employment contract, including but not

limited to faculty, staff, exempt, casual and management

employees

(9)

Employer:

Mount Royal University, the Mount Royal University

Foundation or the Mount Royal University Child Care

Centre

(10)

Expense Approver:

means the individuals holding specified positions with the

responsibility and authority to authorize expenditures. The

authority to approve Travel and Expense claims may not be

delegated below the level of Manager or Chair. For

expense claims related to professional development

activities, the appropriate signing authority is the

Department Head, Dean or Director of the respective area.

(11)

Incidental Expense

Allowance:

An allowance to cover the costs of items which can be

attributed to a period in travel, but for which no other

reimbursement or allowance is provided under this

document and to help offset some of the expenses incurred

as a result of having to travel. It includes but is not limited

to such items as gratuities, laundry, dry cleaning, bottled

water, phone calls home, grass cutting, snow removal,

home security check, plant watering, mail services, pet

care, telecommunications hook-ups and service, and

shipping of some personal effects.

(12)

Policy:

means the Travel and Expense Policy

(13)

Prior Approval:

written approval for travel prior to any related commitments,

expenditures or start of the activity

(14)

Purchasing Card

(P-Card):

a credit card supplied by a financial institution and used by

Mount Royal to enable cardholders to make purchases and

payment of low dollar value purchases, travel and hosting

expenses

(15)

Reasonable

Expenditure:

An expenditure that is considered to reflect prudence, good

judgment, due diligence and is defensible as a business

activity to an impartial observer.

(16)

Receipt:

An original detailed document, provided by the merchant

showing the name and address of the merchant, the CRA

issued business number (if Canadian and applicable), the

date of the purchase, an invoice/receipt number, an

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 15 of 21

itemized description of the goods or services purchased,

the total amount of tax charged, any shipping charges (if

applicable), and the total amount of the invoice including

taxes and delivery and/or service charges. The submission

of a credit card or debit card receipt indicating payment is

not sufficient on its own.

(17)

Spouse or Partner:

Persons recognized as spouse or partner as per the

respective University collective agreements, or equivalent.

(18)

Student:

A student of the University currently enrolled in the

programs offered at the University.

(19)

Traveller:

A person who is authorized to travel on University related

business. This may include employees, members of the

Board of Governors, students and/or representatives who

are authorized to travel on University business.

(20)

University:

means Mount Royal University

(21)

University Business

Travel:

A person who is authorized to travel on University related

business. This may include employees, members of the

Board of Governors, students and/or representatives who

are authorized to travel on University business.

E.

RELATED POLICIES

●

Hosting Expense Policy

●

Contractual Signing Authority Policy

F.

RELATED LEGISLATION

●

Alberta Election Finances and Contributions Disclosure Act.

●

Alberta Freedom of Information and Protection of Privacy Act.

G.

RELATED DOCUMENTS

●

Canada Revenue Agency Income Tax Bulletin – Employee Fringe Benefits

●

Expense Report Form

●

Federal Treasury Board per diem Rates

●

Hosting Expense Procedures

●

Missing Receipt Form

●

Purchasing Card Procedures

●

Contractual Signing Authority Procedures

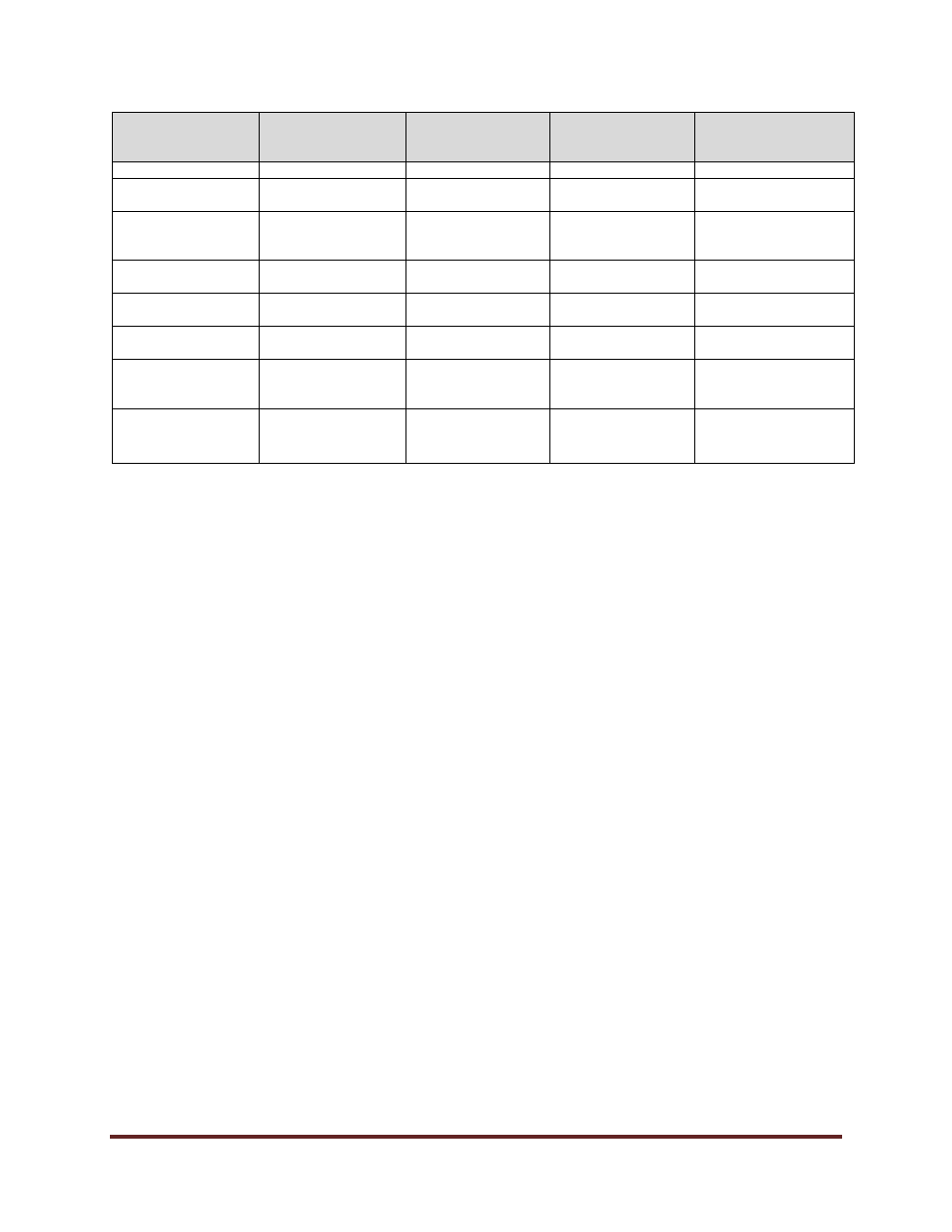

H.

REVISION HISTORY

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 16 of 21

Date

(mm/dd/yyyy)

Description of

Change

Sections

Person who

Entered Revision

(Position Title)

Person who

Authorized Revision

(Position Title)

02/13/2012

Major revisions

08/15/2018

Editorial changes -

titles

University Secretary

10/28/2021

Updates to

reimbursement

amounts

Appendix A

Policy Advisor

General Counsel and

University Secretary

12/06/2021

Editorial – Policy

Contact title

Policy Contact

Policy Advisor

General Counsel and

University Secretary

01/19/2022

Editorial

Related Policies

Policy Advisor

General Counsel and

University Secretary

04/18/2023

Editorial

Definitions

Policy Advisor

General Counsel and

University Secretary

01/22/2024

Updates to

reimbursement

amounts

Appendix A

AVP, Finance

Services

Executive Leadership

Team

03/26/2024

Update to extended

health benefit info

Appendix B

Director, Talent

Management &

Total Rewards

Executive Leadership

Team

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 17 of 21

PROCEDURE TO TRAVEL AND EXPENSE REIMBURSEMENT POLICY

MEALS AND ALLOWANCES

Effective January 22, 2024

APPENDIX A

Maximum

a

75%

b

1. General Travel

Private non-commercial accommodation allowance

20.15

15.12

Maximum per meal allowances

Breakfast

13.00

9.75

Lunch

17.00

12.75

Dinner

27.00

20.25

Maximum incidental allowance

7.35

5.52

Social events that are included as part of a conference program and provide networking opportunities are

considered as an acceptable business expense.

2. Travel in United States of America (THE USA)

All US per diem allowances are paid at par in Canadian dollars when the US dollar is within $0.95 to $1.05 CAD.

Maximum per meal allowances (USD)

Breakfast

20.00

15.00

Lunch

25.00

18.75

Dinner

30.00

22.50

Maximum incidental allowance

14.65

10.99

3. International (outside Canada and THE USA)

Meals and incidentals will be reimbursed at the National Joint Council Rates as outlined on their website at:

https://www.njc-cnm.gc.ca/directive/app_d.php?lang=eng

OR the USA per diem, whichever is deemed more reasonable in reference to the and nature of the travel.

4. Use of Private/Personal Vehicle

Kilometre Rate

$ 0.550

This KM rate is considered to include fuel, fluids and lubricants, wear and tear, registration and insurance for

the usage of the private/personal vehicle while on University business.

Daily Vehicle Allowance per day (replaces km rate)

$10.25

Allowance for each day an employee’s private vehicle is used on University business in a given week.

Adverse Driving Allowance per day (added to km rate)

$8.55

Additional allowance when 10km or more is driven on unpaved roads

or travel is over terrain without roads,

or vehicle must be frequently stopped and parked 5 or mote times in a single trip in an urban area.

Other use of private vehicle – per km rate

$0.165

Rate allowable when the employee uses their private vehicle where another means of transport is more

appropriate.

a

The maximum allowances paid to the traveller without the presentation of a detailed receipt. Travellers are expected to claim the actual

costs incurred for meals on business travel. Any amount above these stated maximum rates require the presentation of a detailed

receipt and justification to the respective Expense Approver for approval.

b 75% of the meal and incidental allowances shall be paid for University business-related travel exceeding 14 consecutive calendar days

while at the same location when corporate residences and/or apartment hotels are available to the traveller in the area surrounding the

workplace, or the traveller chooses to stay in private accommodation

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 18 of 21

PROCEDURE TO TRAVEL AND EXPENSE POLICY

INSURANCE

(Effective: January 1, 2011)

APPENDIX B

Vehicle Insurance

1.

Authorized Drivers

Persons intending to operate University owned or rented vehicles for University business

must be registered with the Risk Manager prior to the intended activity to be approved as

authorized drivers.

Authorized Drivers are responsible for familiarizing themselves with the Vehicle Use Policy

prior to travel and agree to adhere to all aspects of the policy throughout.

2.

Driver Licence Requirements

Authorized Drivers for University-owned or rented vehicles carrying 14 passengers or less

must possess a valid Canadian class 5 driver’s license (or better) with less than 6 demerit

points. For University-owned or rented vehicles carrying more than 14 passengers, an

Authorized Driver will be required to possess a valid Canadian class 4 driver’s license (or

better) with a maximum of 6 demerit points.

3.

University-Owned Vehicles

Mount Royal University employees, contractors or volunteers (with prior written permission

from the Department Head) may be approved to use Mount Royal University vehicles

provided they are registered on the list of Authorized Drivers and the vehicle will be used

for University purposes. Provided none of the provisions in the Vehicle Use policy are

violated the University insurance program will cover claims on third party liability, accident

benefits, comprehensive and collision arising from the use of these vehicles.

3.1

Reporting a Claim

Alberta provincial law stipulates that

accidents resulting in injury, death or

damages exceeding $1,000 must be reported to the police immediately. The

$1,000 figure is the combined damage total to all vehicles, property, etc.

For ALL accidents involving a University-owned vehicle, regardless of the

amount of damage (including vandalism, hit and run, and accidents under the

deductible), the driver of the vehicle must contact Security Services in addition to

any required contact with local law enforcement in the jurisdiction of the accident.

For further details regarding driver responsibilities and insurance coverage while driving

Mount Royal University Vehicles, please consult the Vehicle Use Policy.

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 19 of 21

4.

University Rented Vehicles

We recommend the traveler purchase the additional coverage at all times for rental

vehicles. If you are a University Corporate Credit Card holder, the use of this card as

payment provides the additional insurance required.

The University insurance program provides excess insurance over and above that which

the Rental Agencies carry. The liability coverage provided by the Rental Agency and the

University’s excess policy should provide sufficient coverage

while you are engaged in

University business. If you are not engaged in University business at the time of the

accident, you

will NOT be covered by the Mount Royal University liability insurance

policy.

4.1

Corporate Credit Card

Additional theft and collision damage insurance can be obtained at no additional

cost if an Employee rents a passenger vehicle using their MRU Corporate Credit

Card. In this circumstance, the employee is advised to deny the rental company's

insurance coverage and initial their damage waiver at the time of rental.

For further details regarding driver responsibilities and insurance coverage while

driving rented vehicles on Mount Royal University business, please consult the

Vehicle Use Policy.

5.

Driving Personal Vehicles on University Business

If you are using your personal vehicle for MRU business, (including meetings) you must

notify your insurance carrier. They may amend your policy to include business use and

may add an endorsement to carry passengers for compensation. Your personal vehicle

is not covered under MRU’s insurance policy and any claims made or costs incurred due

to loss or damage while operating a personal vehicle shall be affected by your personal

automobile insurance policy. This includes bodily injury and property damage to you and

any passengers or third parties.

Where the frequent and routine use of a private vehicle for business activities is required

as a part of the position requirements and, at the discretion of the Expense Approver,

reimbursement may be made for MRU business travel in the Employee's personal vehicle

for the incremental insurance premium from the level of travel 'to and from work' to the

level of 'for business use.' This should be discussed between the Expense Approver and

the Employee prior to the business related travel. For infrequent use, the cost of a rental

vehicle may be considered as more economical.

Medical Insurance

1.

Extended Health Coverage

For Management, Support Staff, full-time Faculty and eligible part-time staff the medical

coverage under Extended Health Care contains provisions for medical emergencies while

travelling, vacationing or otherwise temporarily residing outside of Canada. This coverage

will provide for treatment by a physician, hospitalization, pharmaceuticals and other

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 20 of 21

necessary medical treatment while you are travelling. In addition, the Survivor Benefits

coverage can provide compensation in the event of traumatic injury (loss of limb, hearing,

vision or paralysis) or death anywhere in the world. If you have any question regarding

your eligibility contact the benefits office before travelling.

1.1

Travel Cards

All employees should carry with them the card issued by the MRU’s Health provider which

provides emergency contact numbers and other policy information which will be required

should a medical emergency occur while travelling. Employees can also access the travel

card through the Provider’s App. In the event of a medical emergency the insured or a

representative thereof must call be Travel Insurance Provider as soon as possible before

or after receiving medical treatment. Please contact

benefits@mtroyal.ca

if you have any

questions regarding your coverage or if you will be out of the country for more than 60

consecutive days, as the insurance provider must approve extensions.

2.

Corporate Credit Card

Further compensation for traumatic injury while travelling on a common carrier (i.e., a bus,

train, aircraft or other conveyance which transports passengers for a fare) is available if

the University Corporate Credit Card is used to purchase the fare. The coverage offered

through the Corporate Credit Card only applies to injuries sustained while actually

travelling on a common carrier or at a terminal immediately before or after travelling.

3. Not on University Benefits Plan

For travelers not covered under the University Benefits Plan we recommend:

●

The traveller review and understand other potential coverage held prior to travel from

such sources as a spousal plan or by personal credit card coverage, or

●

The traveller purchase travel accident insurance for duration of travel.

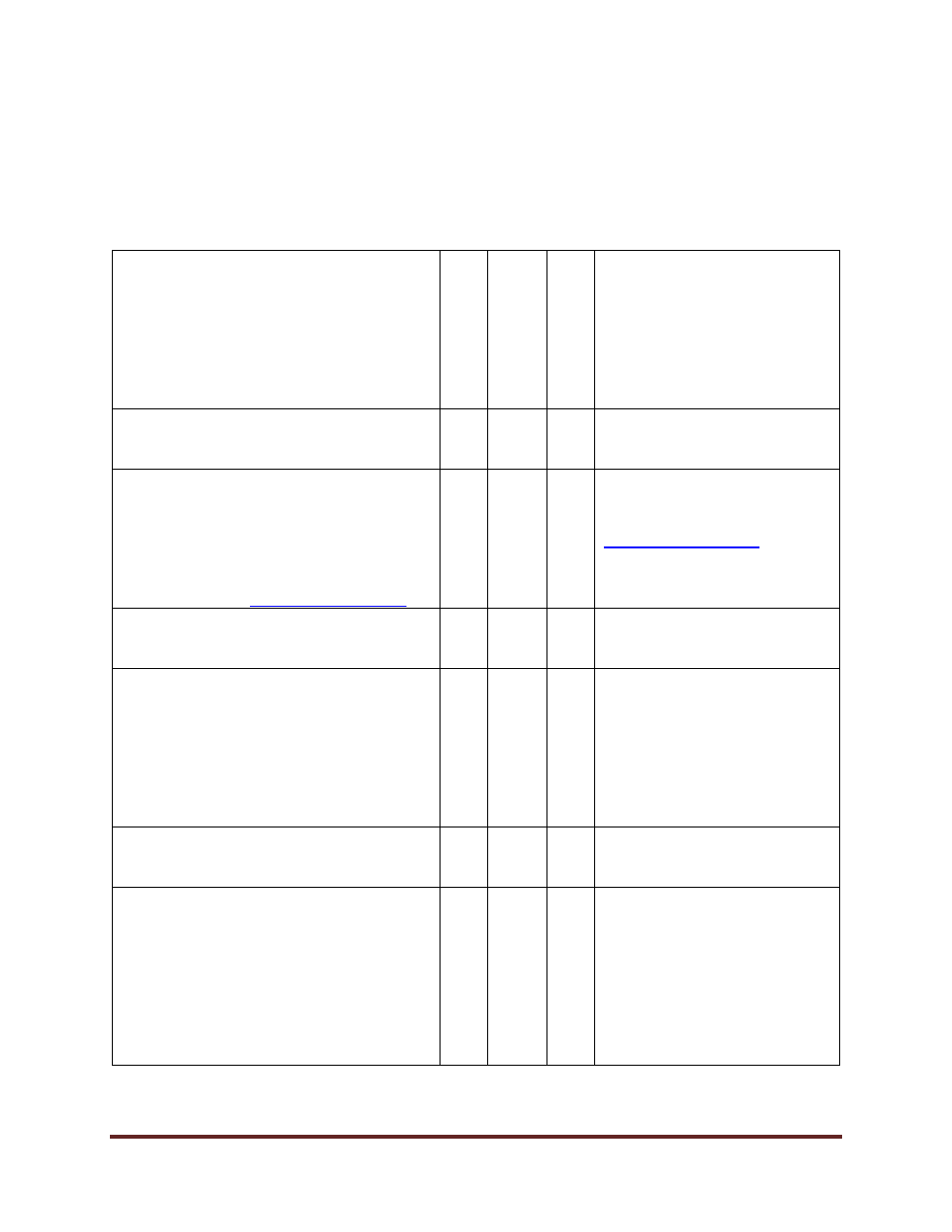

See Medical Travel Insurance Decision Tree on following page to ensure appropriate coverage.

Travel and Expense Reimbursement Procedures – February 13, 2012

Page 21 of 21

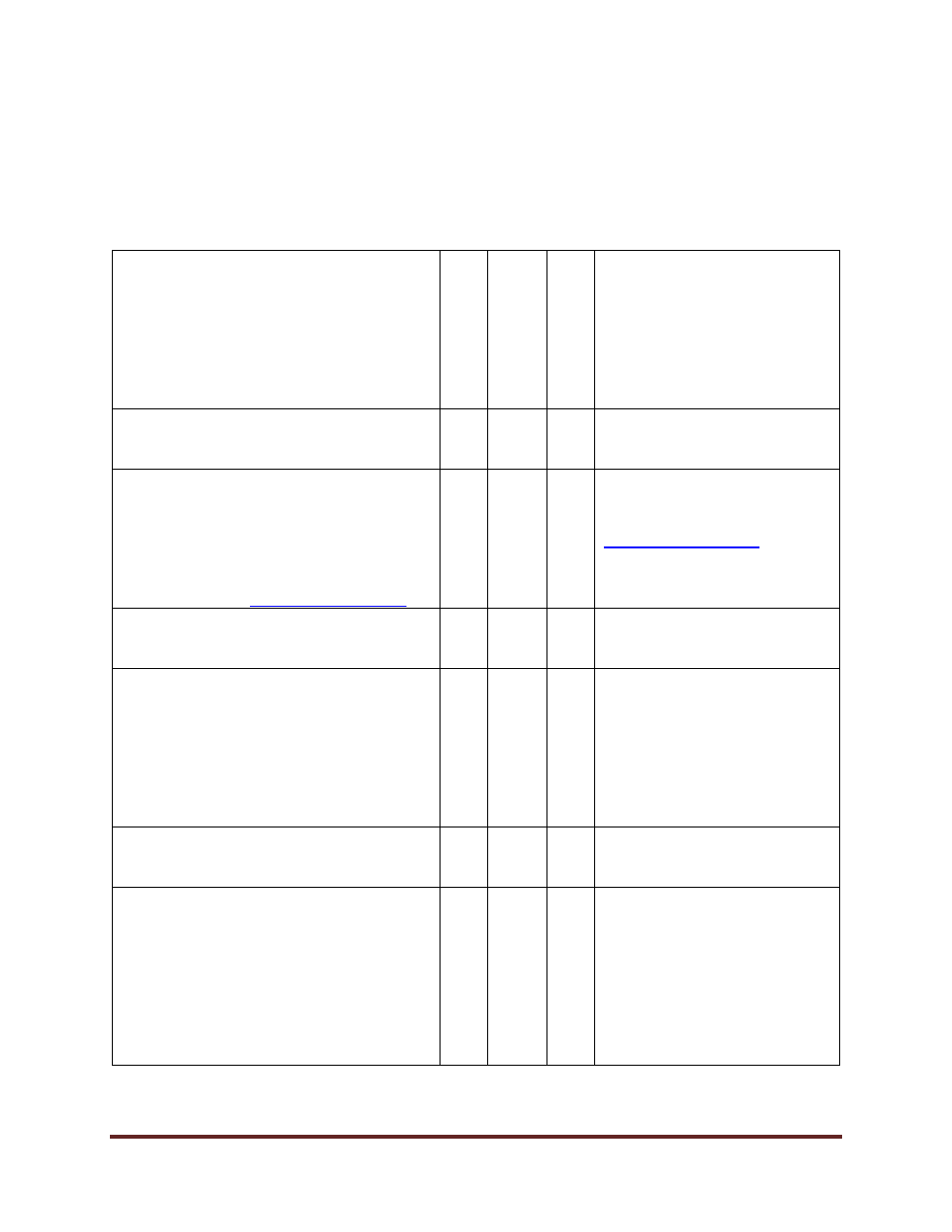

Medical Travel Insurance Decision Tree

Prior to commencing travel outside of Canada, the traveller should ensure they are adequately

covered to deal with any medical needs or emergencies while on travel status. Please read

through the following decision tree to ensure you have active, adequate coverage.

Is the traveller a Student?

→

Y

E

S

→

Ensure travel coverage

through MRU student

insurance provider or provide

documented proof of

equivalent coverage for

duration of travel. Contact

International Education office

prior to travel.

↓

NO

↓

Does traveller participate in MRU

Extended Health Care Benefits through

MRU’s service provider? (If unsure, see

MyMRU, Employee Resources tab,

Employee Self-Service, Benefits, and

Current Summary. Or contact the

Benefits team at

benefits@mtroyal.ca

.

→

Y

E

S

→

For detailed information on

specific travel coverage,

contact the Benefits team at

benefits@mtroyal.ca

.

Proceed with travel and the

providers travel card for

duration of travel.

↓

NO

↓

Does traveller remain sufficiently

covered with Medical Travel Benefits

through alternate service provider

(spousal or family plan) in lieu of MRU’s

Extended Health Care?

→

Y

E

S

→

Ensure the coverage

provided through the

alternate provider provides

full travel coverage. Proceed

with travel and carry

coverage reference cards or

documentation for duration of

travel.

↓

NO

↓

Purchase Medical Travel Coverage prior

to commencement of travel through

service providers to cover the complete

duration of travel. Such coverage may

be purchased from a variety of service

providers, including your credit card

company, travel agents, Alberta Motor

Association, general insurance service

providers and others.