Investment Policy

– December 1, 2023

Page 1 of 13

INVESTMENT

POLICY

Policy Type:

Board

Initially

Approved:

February 10, 2014

Policy Sponsor:

Board of Governors

Last Revised:

December 1, 2023

Administrative

Responsibility:

Associate Vice-

President, Finance and

Commercial

Operations

Review

Scheduled:

December 1, 2025

Approver:

Board of Governors

Policy Summary: This Policy outlines the objectives, principle and strategy for the investment of University

funds.

A.

OVERVIEW

The Board of Governors of Mount Royal University has fiduciary responsibility for the investment

of University resources. This Investment Policy

(‘Policy’) outlines the principles by which the

University will discharge its responsibility with respect to maintaining, managing and enhancing its

endowment funds by stewarding them in perpetuity,

as well as the University’s working capital

assets, comprised of the short term and long term fund, to support the current and future operations

of the University. The University Funds portfolio (

‘Fund’ or ‘Funds’) is made up of the University

Endowment Fund and the University working capital assets, Short-Term and Long-Term Fund.

B.

PURPOSE

The purpose of this Policy is to:

● Provide the framework to define investment return performance goals to achieve a long-term

rate of return that in real terms shall equal or exceed the rate of spending with an acceptable

level of risk.

● Define the investment management structure for University Funds.

● Ensure that all relevant issues are considered in formulating an investment strategy for

University Funds with explicit attention to market risk, foreign currency risk, liquidity risk, credit

risk, and interest rate risk.

● State the investment guidelines and restrictions for University Funds.

● Ensure that there is ongoing communication between the Board of Governors, University

management, investment asset consultants, and investment managers, investment

custodians, and other related services as required.

Investment Policy

– December 1, 2023

Page 2 of 13

C.

SCOPE

Compliance with this Policy extends to all Funds held by the University.

D.

POLICY STATEMENT

1.

OBJECTIVES

1.1

The University determines investment objectives consistent with the investment

principles set out by the Board and based on the needs and various purposes of

the type of funding included in the Fund.

1.2

The primary objectives for the Fund include:

a.

Endowment Fund: To generate sufficient income to meet the approved

spending rate of 3.5% while preserving the principal invested in real

(inflation-adjusted) terms over the long term.

b.

Short and Long-term Funds: To generate a growth component above

short- and medium-term spending needs.

1.3

In order to meet these investment objectives, the Fund is composed of Short-term

and Long-term investments.

1.4

The Endowment principal share of the Long-Term Investment Portfolio is held in

perpetuity and cannot be redeemed. The unendowed working capital share can be

formed by any sources of funds other than the Endowment principal. The

redemptions from the Long-Term Investment Portfolio for cash, which are not sales

in the normal course of the Portfolio rebalancing, can only be performed from its

unendowed working capital share.

2.

FUND MANAGEMENT AND INVESTMENT PRINCIPLES

2.1

Fund investments shall be made solely in the interest of Mount Royal University in

accordance with this Policy.

2.2

The Fund shall be invested with the care, skill, prudence, and diligence under the

circumstances then prevailing that a prudent person in a like position would

exercise under similar circumstances; and, in a manner that the Board of

Governors reasonably believes to be in the best interest of the University.

2.3

Board members and their appointed advisors who possess, or ought to possess,

because of their profession or business, a particular level of knowledge or skill

relevant to their responsibilities to the Fund, shall employ that particular level of

knowledge or skill in the interest of the Fund.

2.4

Investment of the Fund shall be diversified so as to yield target returns within

acceptable levels of risk to minimize the risk of material losses, and without undue

reliance on a single market and/or strategy.

Investment Policy

– December 1, 2023

Page 3 of 13

2.5

With respect to implementation of the asset mix, investment management fees will

be considered relative to the potential for value-added.

2.6

The Board shall ensure that there is sufficient liquidity to make required

disbursements as they become due.

2.7

It is the Board's intent to continue operating its Investment Portfolio in perpetuity

with a focus on long-term overall investment performance balanced with the need

to meet annual disbursement requirements.

2.8

Available Short-term Working Capital is to be employed productively by investment

in short-term cash equivalents to provide safety, liquidity, and return.

3.

INVESTMENT STRATEGY

3.1

The Board of Governors has approved a combination of active and passive

investment management strategies, where applicable, as the optimal strategy for

the generation of investment returns at the optimal risk level, while providing broad

based, low cost exposure to applicable investment markets.

3.2

The University shall employ an investment management protocol and a diversified

asset allocation strategy using a variety of asset classes, with a goal to:

a.

Preserve the capital of the investment portfolio by limiting risk to an

acceptable level;

b.

achieve a real rate of return; and

c.

subject to (a) and (b), minimize investment management costs.

4.

INVESTMENT RESPONSIBILITIES

4.1

The Board maintains full oversight responsibility for University investment activities

through the following structure and delegation of responsibility:

a.

The prime directive of the Board Finance Committee is to monitor the

performance of the investment portfolio in meeting the objectives and

philosophy, and recommend betterments as needed.

b.

Through the Board Finance Committee, assess reports provided by

management regarding Asset Mix, market developments, Manager

performance, and compliance with the Investment Policy.

c.

The Asset Mix will be reviewed by the Board on a semi-annual basis along

with this Policy as recommended by the Board Finance Committee.

5.

INVESTMENT MANAGEMENT and ASSET MIX

5.1

The Board shall monitor the performance of the Short-term Fund. Such monitoring

shall include quarterly performance measurement reporting by management.

5.2

The Investment Portfolio, comprised of the University's Long-term Fund and

Endowment Fund, shall be invested through investment Manager(s) approved by

Investment Policy

– December 1, 2023

Page 4 of 13

the Board of Governors based on recommendations of the Board Finance

Committee (Appendix A). The Manager(s) must comply with the Agreements and

the Accountability Checklist outlined in Appendix B, respectively.

5.3

The investment performance objective for the Investment Portfolio is to provide

returns that approximate as closely as practicable, before expenses, the

performance of each asset class benchmark index over the long term.

5.4

Asset Mix Policy

The long term asset mix policy and tolerance ranges for the Long-Term Fund and

Endowment Fund, as approved by the Board, are as follows:

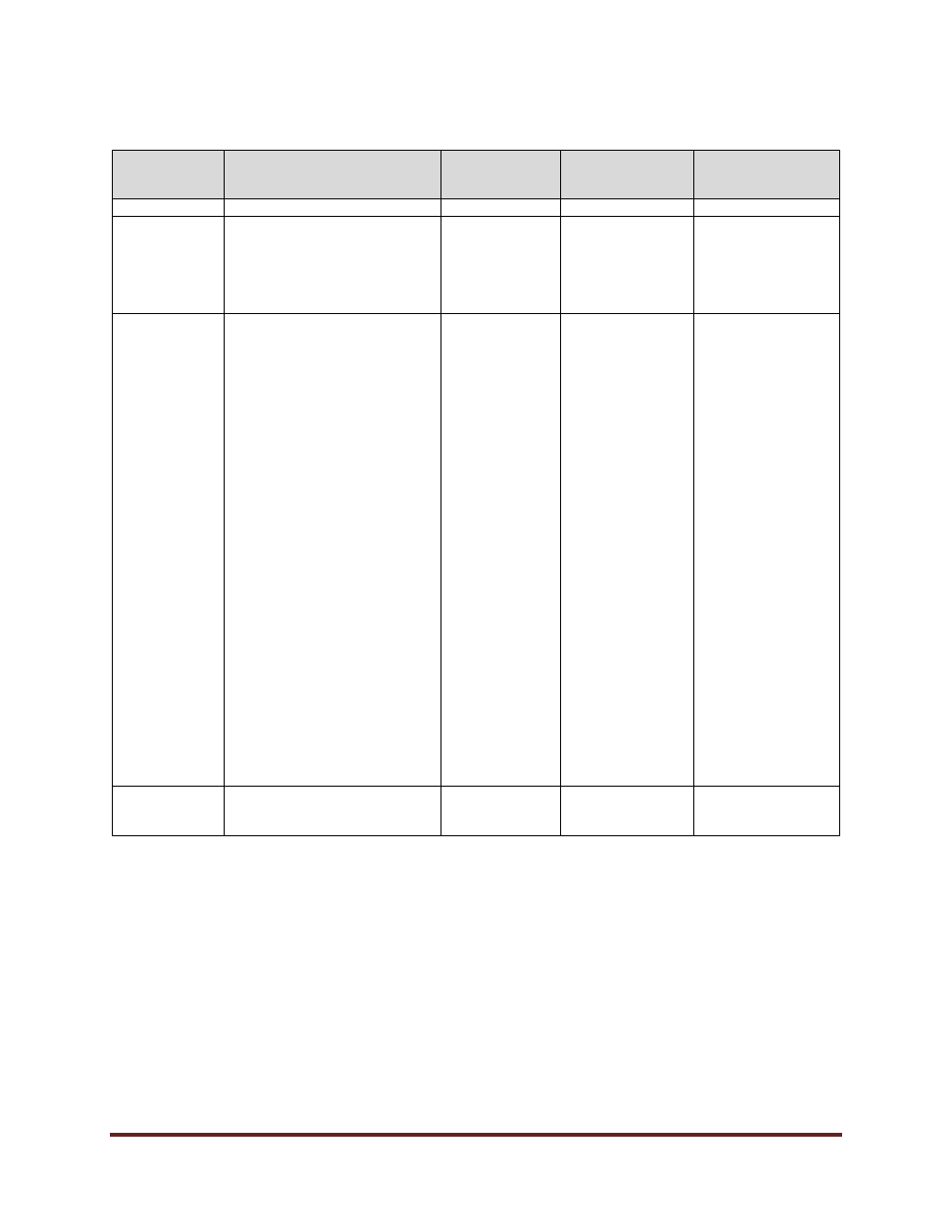

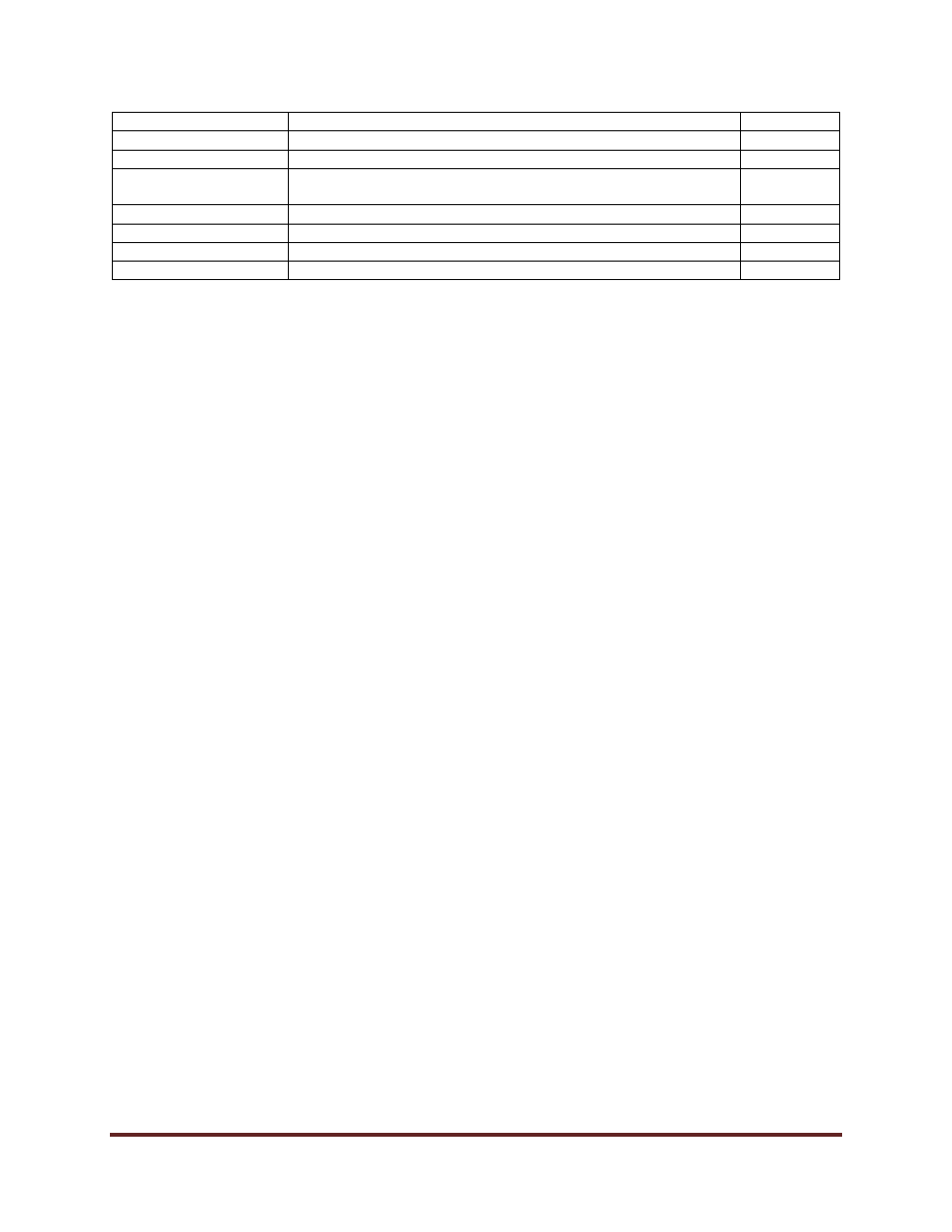

Asset Class

Percentage of Total Fund Market Value

Minimum

Policy

Maximum

Cash & Short Term

0%

0%

5%

Universe Bonds

10%

15%

20%

Mortgages

2.5%

10%

17.5%

Total Fixed Income

12.5%

25%

32.5%

Canadian Equity

10%

20%

30%

Global Equity

25%

35%

45%

Total Equity

45%

55%

65%

Canadian Real Estate

2.5%

10%

17.5%

Global Infrastructure

2.5%

10%

17.5%

Total Alternatives

5%

20%

30%

Total

100%

5.5

Management shall monitor the market value of each Asset Class within the

Investment Portfolio and shall rebalance between Asset Classes as set out in the

asset mix table above. An Asset Mix review will be performed monthly and

investments re-balanced upon approval of the Associate Vice-President, Finance

and Commercial Operations.

6.

RISK AND DIVERSIFICATION

6.1

The investment objectives as described in section D., 1, have been reviewed by

the Board with advice from an Asset Consultant with regard to the risk tolerance

of the Board.

6.2

The uncertainty of future economic and investment conditions calls for prudent

diversification in the investments of the Fund to reduce risk. Diversification requires

the use of different Asset Classes within the Fund.

7.

PERMITTED CATEGORIES OF INVESTMENTS

7.1

Subject to section D., 5, of this Policy, the Fund may invest in any or all of the Asset

Classes and their subcategories listed below:

Investment Policy

– December 1, 2023

Page 5 of 13

a.

Public equities, including common and preferred shares and equivalents,

such as warrants, rights, installment receipts, unit trusts, and convertible

debentures, all of which may be issued by Canadian or non-Canadian

issuers;

b.

Debt instruments of Canadian and non-Canadian issuers, issued in

Canadian or Non-Canadian currencies, including bonds, loans,

convertibles, securitized instruments and debentures;

c.

Commercial mortgages;

d.

Real Estate investments invested in actively managed open-end or

closed-end real estate pooled funds or real estate investment trusts;

e.

Infrastructure investments invested in actively managed open-end or

closed-end global infrastructure pooled funds;

f.

Guaranteed investment certificates or equivalent of insurance companies,

banks or other eligible issuers;

g.

Annuities, deposit administration contracts or other instruments regulated

by the Insurance Companies Act or comparable provincial law, as

amended from time to time;

h.

Term deposits offered by banks or other financial institutions where

deposits are guaranteed by CDIC or an equivalent guarantor; and/or,

i.

Cash, treasury bills or money market securities issued by governments,

government agencies or corporations.

7.2

Managers may utilize the following financial instruments provided that participation

has been specifically listed in the pooled fund investment policy and/or the

Investment Management Agreement:

a.

Futures and other derivative instruments.

b.

Currency forwards, futures and options used to hedge foreign currency

exposure.

c.

Equity and Fixed Income indices including Exchange Traded Funds (EFT)

provided the underlying investments qualify under clause D., 7, 7.1.

d.

Derivative products designed to transfer or change certain characteristics

of the underlying investments, provided that those underlying investments

and characteristics qualify under Section G.

7.3

The Fund may not invest in:

a.

Commodities or derivative instruments related thereto.

b.

Collectibles.

c.

Investment instruments that create a leveraged liability greater than the

original investment (some Hedge Funds and potentially some Income

Trusts).

d.

Non-listed shares.

Investment Policy

– December 1, 2023

Page 6 of 13

e.

Derivative instruments not specifically permitted above.

f.

investments not permitted for the Fund under applicable legislation (if any).

7.4

The Fund may not engage in speculative hedging.

7.5

Short-term investments managed directly by the University

a. The Short-term investments shall be invested in liquid securities with a term to

maturity of no more than one year, or held in cash.

b. All short-term investments shall be a minimum rating of DBRS R-1 (high), or

equivalent.

c. Not more than 10% of the short-term component of the Investment Portfolio

shall be invested in any one issuer except for securities of, or guaranteed by:

• the Government of Canada;

• or a province of Canada having at least AA DBRS or equivalent credit

rating, and whose short-term investments are rated R-1 (high) or

equivalent;

• or a Canadian bank having at least a AA DBRS or equivalent credit rating,

and whose short-term investments are rated R-1 (high) or equivalent.

7.6

Commingled Vehicles

Where investments are made through mutual or pooled funds, those investments

are to be governed in accordance with the investment policy of the mutual or pooled

fund which will supersede any other specific constraints in this Policy.

8.

DONATED SECURITIES

Subject to market conditions, donated securities will generally be sold immediately upon

receipt by the University. However, where it is deemed advantageous to not immediately

dispose of donated securities to avoid price impairment due to limited security trading

volume, the University may employ an alternate disposal strategy. All circumstances

where the University elects to hold donated securities for a period exceeding 30 calendar

days shall be reported to the Finance Committee of the Board of Governors.

9.

INVESTMENT AND PERFORMANCE OBJECTIVES

The primary objective for the Endowment Fund is to achieve, over moving four-year

periods, a real rate of return, before fees, of 3.5% which is

the Endowment’s approved

spending rate.

A secondary objective is to achieve, over moving four-year periods, a gross rate of return,

at least equal to the benchmark allocations defined in the table below.

The primary objective for the Long-Term Fund is to achieve, over moving four-year periods,

a gross rate of return, at least equal to the benchmark allocations defined in the table below.

Investment Policy

– December 1, 2023

Page 7 of 13

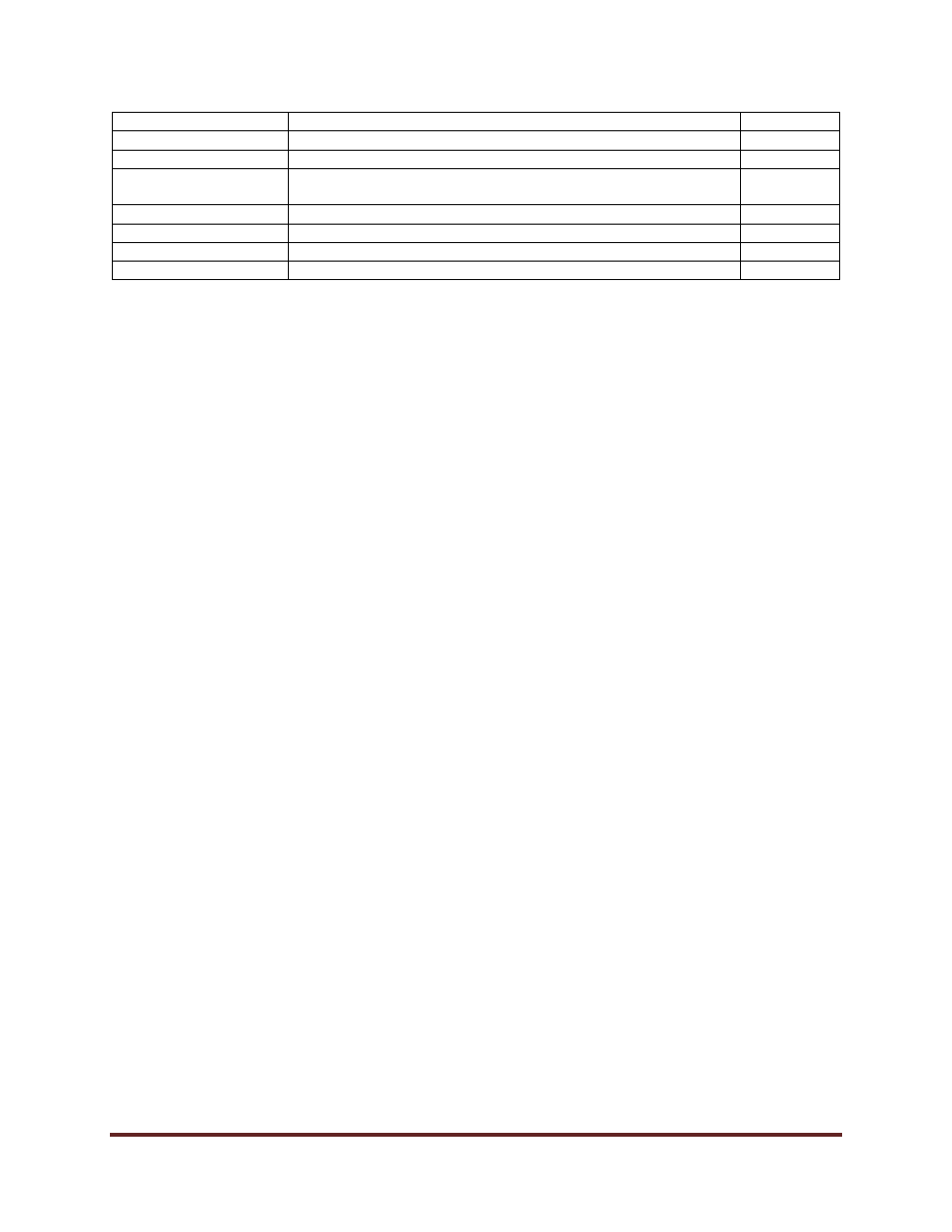

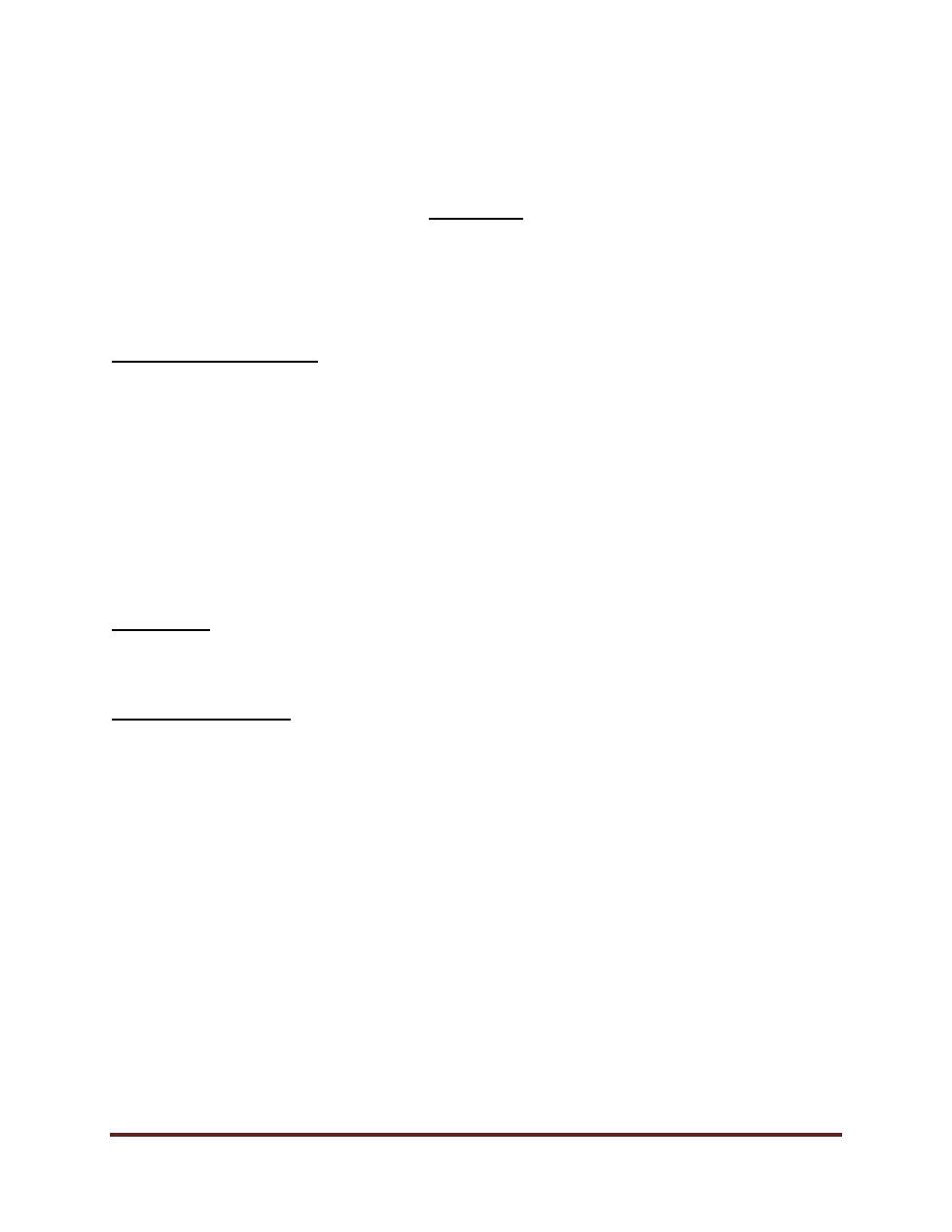

Asset Class

Benchmark

Portfolio %

Cash and Short Term

FTSE Canada 91 Day T-Bill Index

0%

Universe Bonds

FTSE Canada Universe Bond Index

15%

Mortgages

60% FTSE Canada Short-Term Bond Index + 40% FTSE

Canada Mid-Term Bond Index + 50 bps

10%

Canadian Equities

S&P/TSX Composite Index

20%

Global Equities

MSCI ACWI ex-Canada Index

35%

Canadian Real Estate

MSCI/REALpac Canada Annual Property Index

10%

Infrastructure

CPI + 4%

10%

The primary objective for the Short-Term Fund is to achieve, over moving four-year

periods, a gross rate of return, at least equal to the FTSE Canada 91 Day T-Bill Index.

An overall Investment Portfolio performance report shall be prepared by the Asset

Consultant and provided annually to the Board Finance Committee and the Board of

Governors. Such report shall present the current Investment Portfolio in relation to the

relevant index benchmarks; address developments in the corporate investment

environment; and, may include recommendations related to Asset Mix and/or new Asset

Classes for future consideration.

Changes to the Mandate structure shall be undertaken only after consideration of a study

regarding the alternatives, their benefits and drawbacks, reference to the experience of

other funds, and supported by analysis and recommendations from an Asset Consultant.

10.

ADMINISTRATION

10.1 VALUATION OF INVESTMENTS

Investment in mutual or pooled funds shall be valued according to the guidelines

of the mutual or pooled fund.

10.2 RELATED PARTIES

Related Parties of the Fund include:

a.

The University and its Board, committees and employees,

b.

The investment Manager(s) hired to invest the assets of the Fund,

c.

the Custodian(s) of the Fund, and

d.

the Asset Consultant(s) of the Fund.

Assets of the Fund may be invested in the securities of, or involved in a transaction

with, a Related Party.

Any actual or perceived conflict of interest shall be reported as outlined in section

D., 10.3.

10.3

CONFLICTS OF INTEREST

a.

A conflict of interest, whether actual or perceived, is defined for the

purposes of this Policy as any event in which a Related Party may benefit

Investment Policy

– December 1, 2023

Page 8 of 13

materially from knowledge of, participation in, or by virtue of, an investment

decision or holding of the Fund.

b.

Should a conflict of interest arise, the party in the actual or perceived

conflict, or any person who becomes aware of a conflict of interest

situation, shall immediately disclose the conflict to the Chair of the Board

of Governors. The party to the conflict shall thereafter abstain from

decision-making with respect to the area of conflict, and a written record

of the conflict shall be maintained by the Board of Governors.

c. Where an actual or perceived conflict of interest arises, the nature and

substance of the conflict will be disclosed to all affected parties as soon as

possible and in any event within 30 days after the conflict has arisen.

10.4

LOANS AND BORROWING

a.

No part of the Fund shall be loaned to any persons, partnership or

association except as provided in this Section.

b.

The Fund does not engage in Securities Lending however, mutual or

pooled funds may lend securities if permitted under their investment

policies.

c.

The assets of the Fund may not be pledged, hypothecated, or otherwise

encumbered in any way except where temporary overdrafts occur in the

normal course of business.

d.

The Custodian of the Fund shall not borrow on behalf of the Fund except

to a limited and temporary extent and only for the timely payment of

disbursements or administrative costs.

e.

Borrowing or leverage may be used by the investment manager(s) in the

infrastructure and real estate funds where it is common practice to do so.

10.5

VOTING RIGHTS

a.

The responsibility of exercising and directing voting rights acquired

through Fund investments shall normally be delegated to the Manager, to

be exercised in accordance with the mutual or pooled fund’s policies.

a.

The Board reserves the right to direct or override the voting decision of

any Manager if in its view such action is in the best interests of the

Investment Portfolio and such rights are available in the prospectus of the

respective investment Mandate.

10.6

REVIEW MEETINGS

The Finance Committee shall meet face-to-face at least once every two years with

each Manager and/or as otherwise called by the Chair, to:

a.

Review the assets and net cash flow of University funds;

b.

Review the composition of the Strategy and take any action necessary to

ensure compliance with this Policy;

Investment Policy

– December 1, 2023

Page 9 of 13

c.

Receive and consider analysis of the investment performance of the

Strategy;

d.

Review the current economic outlook and investment plans of the Strategy

and review major events within the portfolio and the Manager firm since

the last meeting;

e.

Receive and review reports describing compliance with the Agreement.

E. DEFINITIONS

(1)

Asset Class:

a group of securities that exhibit similar characteristics, behave

similarly in the marketplace, and are subject to the same laws

and regulations. The asset classes identified for the Fund include

equities stocks), fixed-income (bonds), real estate, infrastructure,

commercial mortgages and cash equivalents (money market

instruments).

(2)

Asset Consultant:

third party investment industry consulting firm who provides

expertise, guidance and advice on all or any specific aspects of

the University's investment policies, processes and procedures.

(3)

Asset Mix:

means the allocation of investment portfolio funds among

approved Asset Classes to remain in compliance with the

Investment Policy.

(4)

Board/Board of

Governors:

the Board of Governors of Mount Royal University.

(5)

Endowments:

Donor gifts with external stipulations requiring that the principal

be held in perpetuity with earnings being spent for an intended

purpose.

(6)

Finance Committee:

the Finance Committee of the Board of Governors.

(7)

Fund:

the total of all funds under management of the University.

(8)

Investment Portfolio:

University funds including both long term working capital funds as

well as endowed funds, co-mingled for investment purposes,

invested through the services of external Investment Managers.

(9)

Long-Term:

funds including

University’s working capital and the endowed

funds co-mingled in the University's Investment Portfolio.

(10)

Manager(s):

external professional investment management firm(s) authorized

and contractually engaged for investment of University funds for

specific Asset Class(es) noted within the Investment Policy.

(11)

Mandate:

authorization for an Asset Class of the Fund to be invested

through engagement of an authorized Manager with specific

investment objective, benchmark, Strategy, Strategy attributes,

performance and risk management expectations; see Appendices

C

– H Investment Manager Mandate Statements.

(12)

Policy:

means the Investment Policy.

Investment Policy

– December 1, 2023

Page 10 of 13

(13)

Restricted Funds:

Funds with external stipulations; may require that the principal be

held in perpetuity; and, always with earnings being spent for an

intended purpose.

(14)

Short-Term:

funds invested in term specific accounts as approved by the Board

of Governors from time to time for the specific investment of

balances made up of government grants and tuition fees until

required for operations.

(15)

Strategy:

an investment product or combination of products acquired for

investment in a specific Asset Class. Each strategy has defined

characteristics, objectives and constraints; acquired, under

contract through an external investment Manager or banking

service provider for the investment of University funds. Strategy

characteristics, objectives and constraints are captured in a

Manager Strategy Disclosure Document.

(16)

Tracking Error:

a divergence between the price behaviour of a portfolio and the

price behaviour of a benchmark. Measured as the standard

deviation percentage difference of returns relative to the returns

of the index. Tracking error may be the result of transactional

costs, replication, turnover of assets, management experience,

and/or enhancements such as securities lending.

(17)

University:

means Mount Royal University.

(18)

University Funds:

all funds held by the University, regardless of source or purpose;

in totality also referred to as the Fund.

(19)

Working Capital:

unspent unrestricted funds held by the University for the purpose

of its operational activities.

F.

RELATED POLICIES

● Endowment Management Policy

G.

RELATED LEGISLATION

● Alberta Post-secondary Learning Act

H.

RELATED DOCUMENTS

● Code of Ethics and Standards of Professional Conduct of the CFA Institute

● Investment Mandate Allocation – Appendix A

● Accountability Checklist – Appendix B

● Investment Managers Mandate Statements

● Investment Procedures

● Endowment Management Procedures

Investment Policy

– December 1, 2023

Page 11 of 13

I.

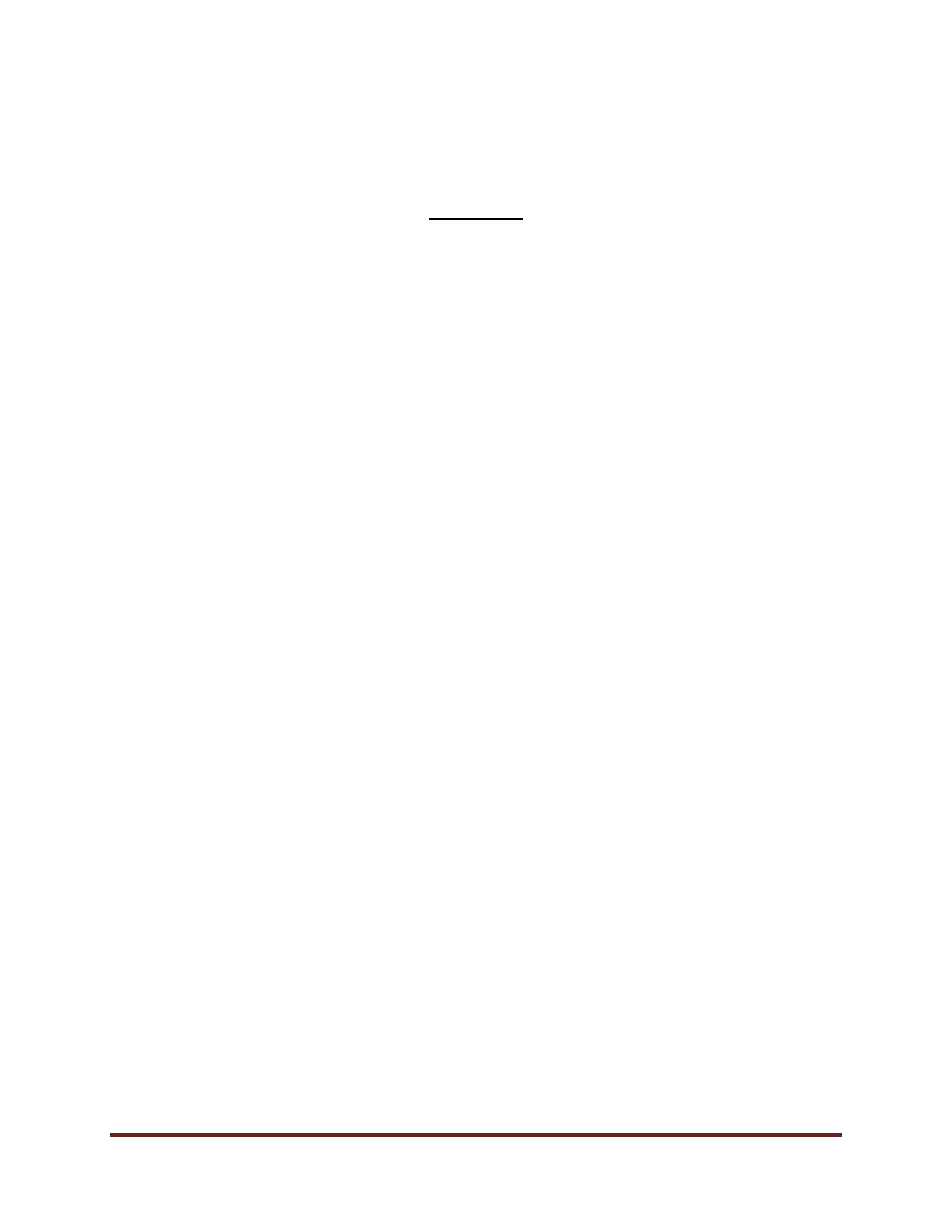

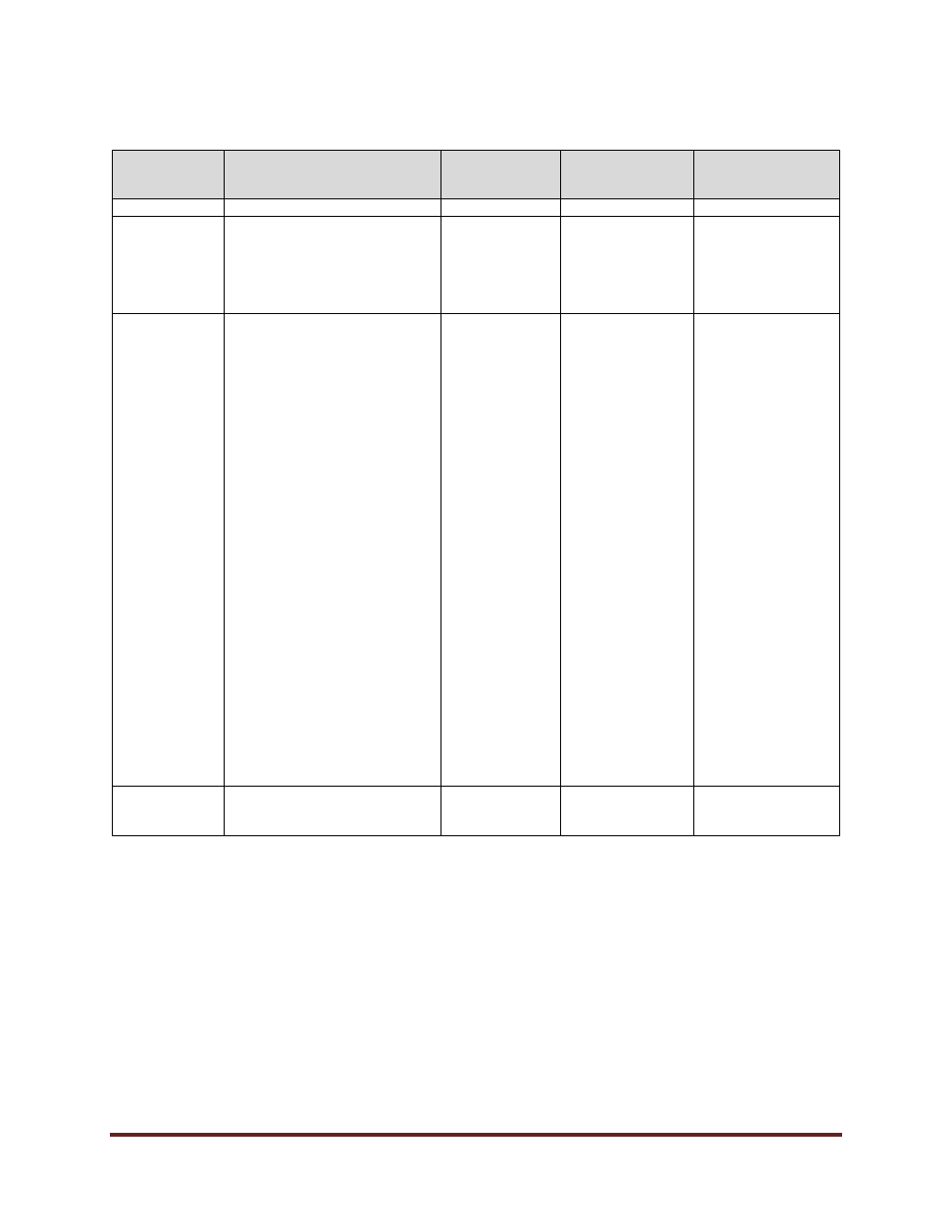

REVISION HISTORY

Date

(mm/dd/yyyy)

Description of Change

Sections

Person who

Entered Revision

(Position Title)

Person who

Authorized Revision

(Position Title)

02/10/2014

NEW

05/28/2018

Asset Allocation Change; updated

Investment Managers Mandate

Statements to align with the

current Fund Declarations and

Strategy documents of the

Investment Managers

D., 5; D., 8;

Appendices A, C,

D, E, F

Treasury Accountant The Finance

Committee of the

Board of Governors

09/29/2021

Enhanced the distinction between

the endowed funds and

unendowed working capital of the

Long-Term Investment Portfolio.

Included actively managed funds

to the permitted categories of

investment.

Updated assets allocation split

and tolerances.

Amended frequency of the BoG

Annual

Amended Appendix A with the

updated legal names of

investment managers and

consultants.

Amendments to reflect the

accountability-based investment

management agreements.

Added Canadian Commercial

Mortgages and Infrastructure

asset classes and Mandates

D.1.4, E

D.3., D.7., D.8.,

Appendix B

D.5., D.8

D.13

Appendix A

D.5., D.13.,

Appendix B

E., H., Appendix

E, Appendix H

Finance Partner

Board of Governors

12/01/2023

Comprehensive revision

A, C, D, F and

Appendices

Mercer (Canada)

Limited;

Finance Partner

Board of Governors

Investment Policy

– December 1, 2023

Page 12 of 13

INVESTMENT POLICY

INVESTMENT MANDATE ALLOCATION

APPENDIX A

The approved investment Managers, Custodian, and Asset Consultants as at December 1, 2023, are set

out below.

MANDATE AND MANAGER:

Canadian Equity:

State Street Global Advisors (SSgA), Ltd.*

Global/US/Emerging Equities:

State Street Global Advisors (SSgA), Ltd.*

Real Estate:

Canada Life Assurance Company

Fixed Income

State Street Global Advisors (SSgA) Ltd

Infrastructure

IFM Global Infrastructure (Canada), LP

Canadian Commercial Mortgages

TD Greystone Asset Management, Inc

CUSTODIAN:

RBC Investor Services and Trust

ASSET CONSULTANTS:

Willis Towers Watson

Mercer (Canada) Limited

Investment Policy

– December 1, 2023

Page 13 of 13

INVESTMENT POLICY

INVESTMENT MANAGERS’ ACCOUNTABILITY CHECKLIST

APPENDIX B

ACCOUNTABILITY:

(1)

Each Manager must comply with the terms of Agreement:

(a)

The Fund shall retain Manager(s) for domestic assets that are registered and in good

standing with the relevant Canadian Provincial Securities Commission (e.g., Ontario

Securities Commission) and, for international assets, Manager(s) who are registered and in

good standing with the Securities and Exchange Commission of the United States of

America. Should the registration of an incumbent Manager be declined or revoked, the Board

should be notified immediately (through the Vice-President, Finance and Administration of

the University), who shall discuss their course of action within 14 days of such notification.

(b)

Managers shall provide the Board with a copy of their policy regarding "Conflict of Interest"

and their Standard or Code of Conduct.

(c)

Managers shall provide an annual compliance statement.

(d)

A set of guidelines shall be established within which each Manager is expected to operate,

including quality standards and performance expectations.

(e)

The Board will determine whether the policies of the indexed funds are acceptable in totality,

whether the investment in the indexed fund is to be discontinued, or whether the University's

Investment Policy is to be amended.

(f)

Each Manager shall notify the Board promptly in writing of any conflict of interest, direct or

indirect, or a substantive change in investment philosophy, key personnel, or corporate

organization.

(g)

The Board shall monitor the performance of each Manager. Such monitoring shall include

quarterly performance measurement and a face-to-face presentation by the Manager to the

Finance Committee as required by the latter. The Board shall also monitor or cause to be

monitored each Manager's turnover of personnel, consistency of investment style, discipline

in portfolio construction, and record of service.

(h)

The Board shall take such steps as it deems appropriate to address any concerns which may

arise from such monitoring. Ultimately, if the Board loses confidence in the ability of the

Manager to achieve the performance objectives of the Mandate, it will replace that Manager.

The Board will annually have a discussion regarding their confidence in each Manager.